Canada’s five largest

pension funds

could move the needle on the

Canadian dollar

if they start hedging their exposure to assets in the United States, says one currency strategist.

Currently, Canada’s big five pension plans hold $1.1 trillion in foreign assets, $0.9 trillion of which is unhedged and includes their U.S. dollar exposure.

“If pension funds raise their hedge ratios even marginally, the

loonie

would significantly outperform its traditional drivers like

interest rate

differentials,” Mirza Shaheryar Baig, a foreign exchange strategist at Desjardins Group, said. “Perhaps this has already begun.”

There are a couple of ways the pension funds can hedge. One is to convert foreign assets such as U.S. equities to local assets, which will improve valuations for Canadian assets and the loonie. The other is to initiate a foreign exchange swap — an agreement to exchange one currency for another — which would also boost the value of the Canadian dollar.

“If that $0.9 trillion becomes $0.8 trillion, that’s still $100 billion, so just the size of these numbers is so large that even a small shift in the percentage would mean a very large amount of foreign exchange transaction,” Shaheryar Baig said.

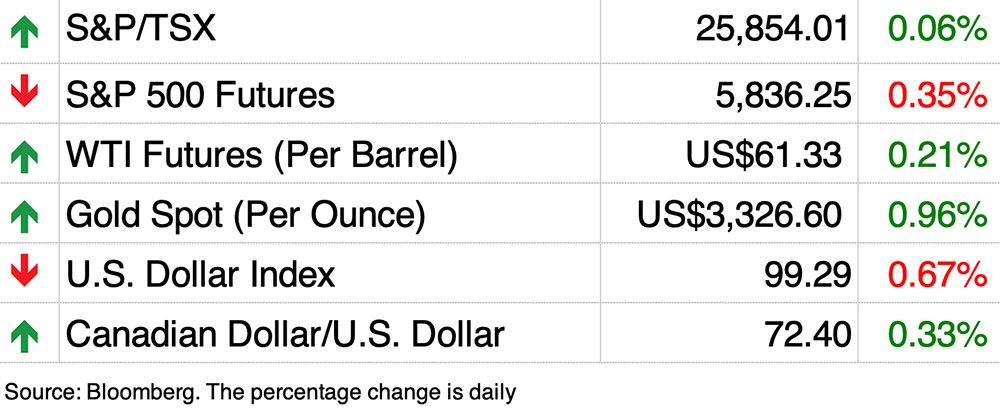

Currently, the loonie is up almost five per cent against the U.S. dollar from its lowest close in just under a decade on Jan. 31, when it appeared the economy would be mauled by U.S.

tariffs

. The

U.S. dollar

index, meanwhile, is down eight per cent this year against a basket of global currencies that includes the loonie.

“The Canadian dollar has actually strengthened relative to the U.S. dollar,” he said.

Shaheryar Baig said that is a strange occurrence because interest rate differentials usually guide how currencies are valued against each other, and U.S. interest rates are at the moment much higher and more attractive to investors at 4.5 per cent versus 2.75 per cent in Canada.

“One of the explanations for why that disconnect is happening is perhaps long-term investors are starting to consider the U.S. dollar as less than a safe currency, or they feel overexposed to U.S. assets,” he said.

The reasons behind that include the effects of the tariff wars on the U.S. economy and the size of that country’s

federal debt

, which stands at US$36 trillion, or 122 per cent of gross domestic product.

In the past, Canada’s top five pension funds have depended on the greenback’s haven status and on the negative correlation between the U.S. markets and the U.S. dollar — where one goes up and the other goes down and vice versa — to protect their U.S. holdings.

That correlation appears broken, Shaheryar Baig said.

“One of the key things that’s happened in the past few months, especially since Liberation Day, is that the U.S. dollar correlation with the stock market has completely flipped,” he said. “And so if investors were hoping that the currency would protect them in a market downturn, now they’re actually seeing their losses compounded through the currency as well.”

Shaheryar Baig said that shift is creating boardroom discussions and some degree of angst among portfolio managers about the fact that their “naked U.S. dollar exposure” is now costing them money.

Sign up here to get Posthaste delivered straight to your inbox.

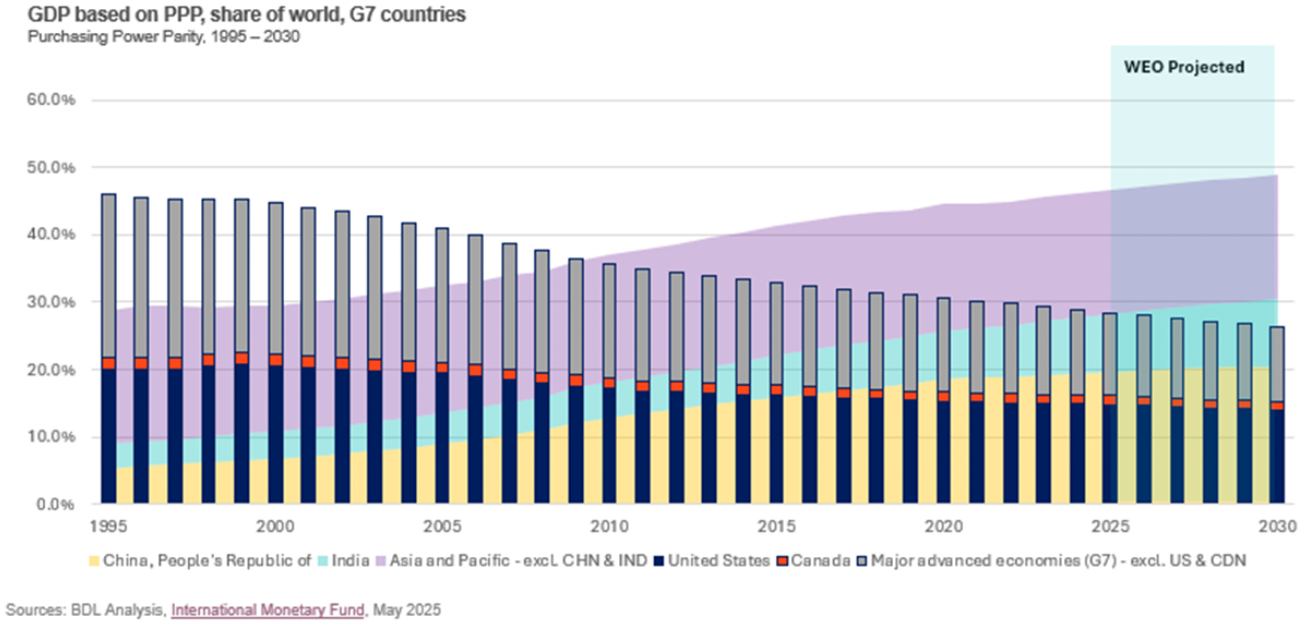

The Group of Seven countries are losing the race for economic dominance.

This chart, released after the G7 meeting of finance ministers in Banff wrapped up on Thursday, shows that G7 members are falling behind emerging economies including China, India and other Asia-Pacific nations, which are surging ahead by taking advantage of younger populations, fast-paced industrialization and centralized manufacturing and global trade.

“By 2030, Asia-Pacific economies are expected to account for nearly 50 per cent of global GDP, with China and India alone projected to generate 30 per cent of global output within just five years,” Marwa Abdou, senior research director at the Canadian Chamber of Commerce, said in a release.

At the start of the next decade, she also estimates that the combined GDP of the United States and Canada will exceed that of all the G7 members, “signalling a chance for North American leadership.”

“If G7 nations want to shape the next chapter of the global economy rather than watch from the sidelines, bold, united action is required.”

The brief for Canada is start investing in productivity, innovation and trade diversification to stay in the game, she said.

- Ambassadors to Canada from G7 countries will sit down with two of Alberta’s leaders on international engagement, Gary Mar of the Canada West Foundation and Martha Hall Findlay of the University of Calgary’s School of Public Policy, to discuss the biggest issues at the G7 summit and what it means for Alberta, Canada and the world.

- Today’s Data: Canada retail sales for March. U.S. new homes sales and building permits.

- Meet Tim Hodgson, the new energy minister Mark Carney hopes can bridge the gap with the West

- TD Bank to cut 2% of workforce in restructuring

- Here’s a plan to fix Canada’s auto sector as its biggest customer tries to turn away

The 2024 tax season is now over for most of us. But what if you made a mistake or found an errant tax slip? Tax expert Jamie Golombek walks you through how to deal with correcting an error. Read more here.

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you starting out or making a change and wondering how to build wealth? Are you trying to make ends meet? Drop us a line at

wealth@postmedia.com

with your contact info and the gist of your problem and we’ll find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course).

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Gigi Suhanic with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: Canada's pension giants have the power to boost the Canadian dollar, says analyst

2025-05-23 12:00:57