Many Canadians hoping to pay down their

credit cards

when they

refinance their mortgage

are finding their options are more limited than they thought, says an industry insider.

Declining home values, lower equity and higher consumer debt are limiting how much some homeowners can access through refinancing or whether they can switch lenders at all, said Leah Zlatkin, a mortgage broker and

LowestRates.ca

expert.

“This is something I’m seeing come up more often in conversations with homeowners as they approach renewal,” said Zlatkin. “Many expect to refinance to deal with debt at that point, only to discover that changes in equity, income, or borrowing limits have already narrowed what’s possible.”

Home prices

in Canada, especially in Ontario and British Columbia, have been falling for over three years now, with some markets suffering double-digit declines.

A drop in the value of the home, combined with loan to value limits, can “significantly” reduce how much equity is available through refinancing, even if the homeowner has kept up with mortgage payments, she said.

The

rising cost of living

has also driven up credit card balances across Canada, with the average rising almost two per cent to $4,652 late last year.

That extra consumer debt that has accumulated after buying a home can reduce borrowing capacity and narrow refinancing options, she said.

Income changes, whether it is through job loss, reduced hours, parental leave or approaching retirement, can also make it harder to qualify for refinancing.

“Renewal is often treated like a reset button, but for many borrowers it reflects decisions made years earlier,” said Zlatkin. “If spending and debt growth outpace home equity, refinancing options can shrink quickly.”

Mortgage pressures continue to build for Canadians, said Morningstar DBRS in a recent report.

The rating agency expects mortgage portfolios for Canadian banks and credit unions to show further credit deterioration in 2026, but remain “reasonably resilient,” despite the soft

housing market

and trade uncertainty.

It does, however, flag certain markets that are exposed to Donald Trump’s tariffs, such as Windsor and Kitchener in Ontario, as especially vulnerable and likely to experience pockets of borrower stress.

Mortgage renewals are another challenge. About 1.15 million mortgages are set to renew this year, and about a third will face higher payments, according to the

Bank of Canada.

The average increase will be six per cent, but five-year fixed mortgage borrowers could face as high as 20 per cent.

“Worse yet, around 10 per cent of variable-rate, fixed-payment mortgage (VFM) borrowers are expected to have a payment increase of more than 40 per cent, which will result in a material payment shock,” said Morningstar.

TFSA vs. RRSP: A wealth-building series from the Financial Post

It’s one of the most important — and sometimes confusing — savings decisions Canadians face, and the right answer depends on far more than a simple rule of thumb. Starting today, the Financial Post is launching a week-long series called TFSA vs. RRSP, breaking down the key questions in deciding between the two accounts, including mistakes to avoid and how to get the most bang for your buck.

Read the first instalment here

and make sure to check back every day this week for more.

Sign up here to get Posthaste delivered straight to your inbox.

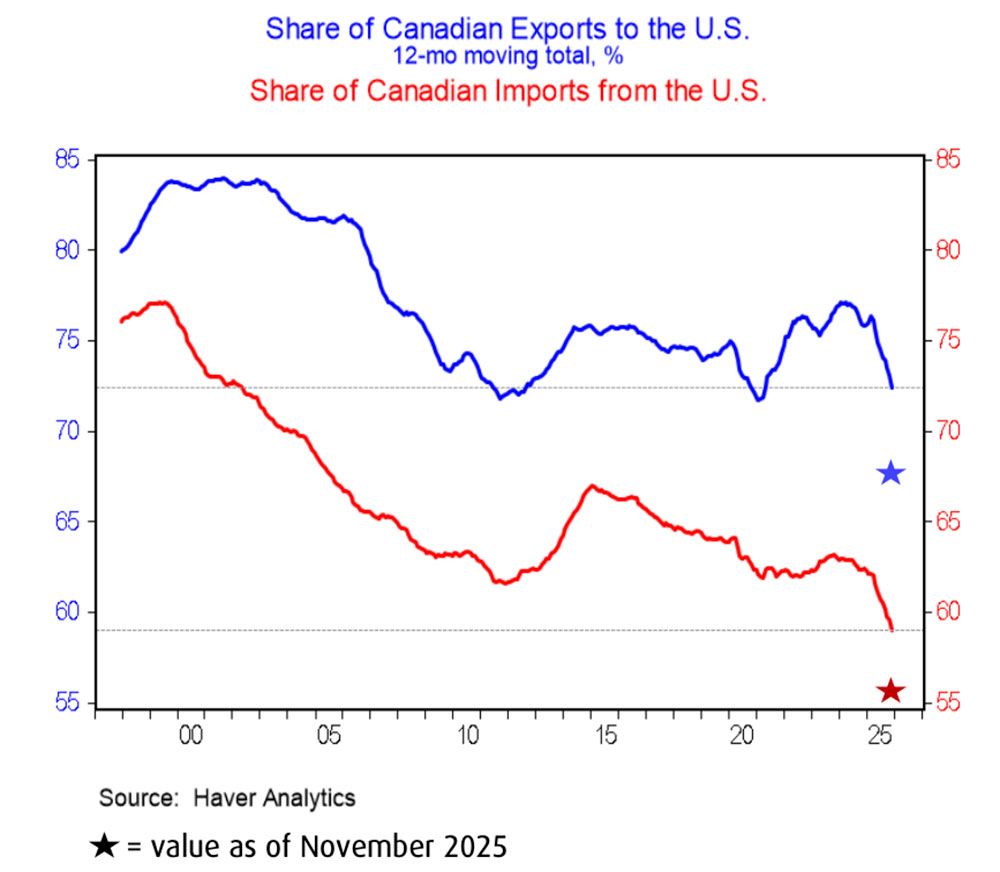

Canada’s trade with its southern neighbour is shrinking, in imports and exports.

The United States made up its lowest share of Canadian imports on records going back to the late ’90s in the 12 months to November 2025, said Shelly Kaushik, senior economist at BMO Capital Markets.

The decline reflects Canadian counter tariffs, which were short-lived, but also the public response shifting away from U.S. products, she said. Also, goods from other countries that previously entered Canada by the U.S. are now being rerouted to avoid tariffs.

Exports to the United States are down, but goods heading to the U.S. still represent more than 70 per cent of Canadian shipments, most protected from tariffs by the

Canada-United-States-Mexico-Agreement (CUSMA).

- Earnings: Suncor Energy Inc., Maraton Petroleum Corp., Pfizer Inc, Electronic Arts Inc, PepsiCo Inc., Merck & Co Inc., Mondelez International Inc., Chipotle Mexican Grill Inc.

- Canadian air travel to the U.S. drops for the 11th straight month

- Eldorado Gold strikes deal to acquire Foran to create new copper-gold producer

- Homegrown companies head to Dubai to sell Canadian AI to the UAE

Do you judge your financial life by a three-digit number? Many people do, but treating your credit score as a grade can lead to anxiety, frustration and even shame, especially when it feels like a good score is the key to opportunity. Credit scores can influence rental applications, credit card approvals and the interest rates offered for loans and mortgages, but it’s only one small part of your financial picture. Credit counsellor Mary Castillo offers some healthier options to financial health than fixating on your credit score.

Find out more

Interested in energy? The subscriber-only FP West: Energy Insider newsletter brings you exclusive reporting and in-depth analysis on one of the country’s most important sectors.

Sign up here.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: Homeownership not the money machine it used to be for many Canadians

2026-02-03 13:01:49