More trouble in

condo land

.

A

report this week by Urbanation Inc.

, which has been analyzing the market since 1981, shows new condominium sales in the Greater Toronto Hamilton Area (GTHA) sank 60 per cent in 2025 to just 1,599 units.

That’s the lowest number since 1991 and marks the fourth straight year of decline. Since 2021 new condo sales have dropped 95 per cent.

A record 28 new condo projects were cancelled in 2025, representing more than double the number of units cancelled in 2024 and the previous high in 2018.

Eight of these projects switched to purpose-built rental but it was not enough to offset the steep decline in condo starts, said

Urbanation.

In the past three years, these have plunged 88 per cent, bringing the total inventory now under construction to a 10-year low.

“As the condo market enters the fifth year of its largest ever correction, the duration of this downturn should be a significant cause for concern as it relates to future supply,” said Urbanation president Shaun Hildebrand.

“By the end of the decade, we know with certainty that there won’t be any new condo completions. What we don’t know is how far into the 2030s the supply crunch will last. If rental construction can’t fill the void, this raises serious questions around the impact on affordability.”

Developers launched only 10 new condo projects last year, and of the 1,425 units only 22 per cent were pre-sold, a severe drop from the high of 81 per cent in 2022.

Investors who traditionally drove pre-construction sales have abandoned the market as the high costs of building the projects and shrinking demand made them unfeasible.

Currently the market is in a glut as declining sales and a wave of completions over the past two years have pushed the inventory higher. A total of 29,291 condo units were completed in 2025, nearly matching the record high the year before.

Yet prices remain higher than for existing condos. The average selling price of a new condo is down 18 per cent from 2022 to $1,123 per square foot, but it’s still a significant premium over a resold condo that goes for $856 psf.

In this environment, Urbanation expects condo completions to fall by 25 per cent in 2026, and to drop again in 2027.

“By 2029, virtually no new condos are expected to be delivered,” said the report.

Sign up here to get Posthaste delivered straight to your inbox.

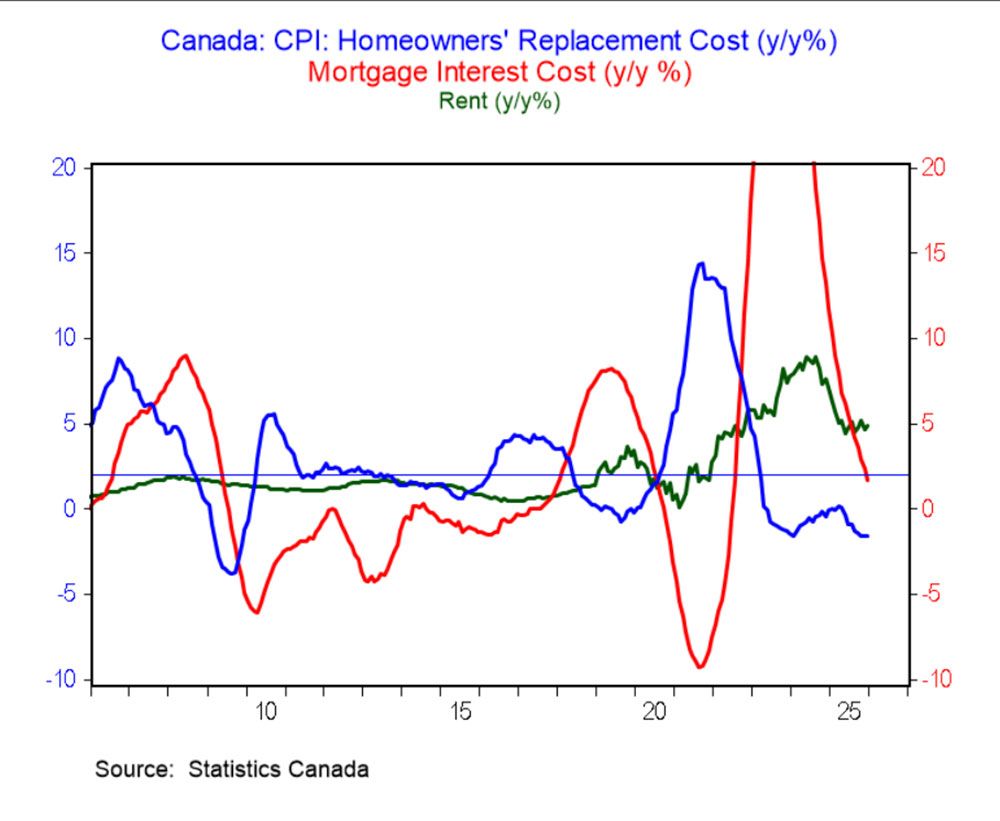

Remember when inflation was roaring during the pandemic and shelter costs were considered one of the biggest culprits. Not any more.

A big reason Canada’s inflation rate has recently cooled to around target is because “three high-profile components” have been slowly marching down, said Shelly Kaushik, senior economist at BMO Capital Markets.

Homeowner replacement costs, which spiked 15 per cent in 2021, have been deflationary for the past two years and mortgage interest inflation has come off record highs after the

Bank of Canada

cut interest rates.

Rent inflation has also cooled and should continue to slow as immigration stalls further, said Kaushik.

- Today’s Data: United States GDP, personal income and spending

- Earnings: Novagold Resources Inc., General Electric Co., Procter & Gamble Co., Intel Corp., McCormick & Co., Abbott Laboratories, Capital One Financial Corp.

- They fled Venezuela’s oil collapse. Now its revival could shake their adopted home

- Carney’s plans to allow Chinese EVs in Canada frustrate auto industry

- Is it time to shift your portfolio to avoid an AI bubble risk or will you lose out on growth?

Rita, 61, and Darcy, 60, built half their careers in the United States and the other half here in Canada. They now live and work in Quebec, but the bulk of their retirement savings are in U.S. employer-sponsored retirement plans. Family Finance has some advice on how the couple can best handle their assets on both sides of the border.

Read more

Interested in energy? The subscriber-only FP West: Energy Insider newsletter brings you exclusive reporting and in-depth analysis on one of the country’s most important sectors.

Sign up here.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: What Toronto's worst condo correction ever will look like in just three years

2026-01-22 13:09:57