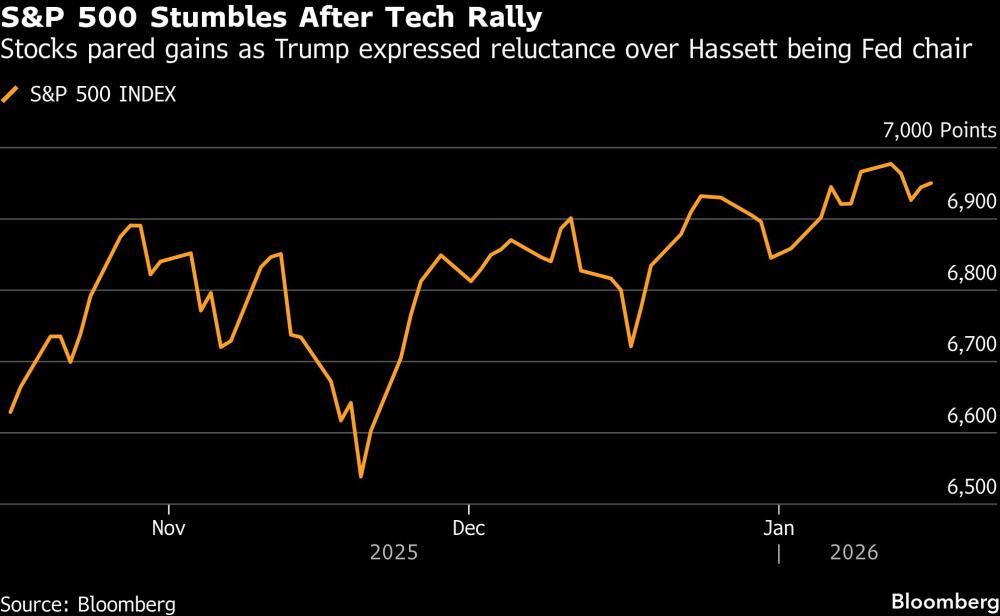

United States stocks

pared gains on Friday as traders mulled President Donald Trump’s reluctance to nominating Kevin Hassett as

Federal Reserve

chair.

The

S&P 500 Index

advanced 0.1 per cent at 1:16 p.m. in New York, paring a gain of as much as 0.3 per cent. Meanwhile, the Nasdaq 100 Index was little changed, while a gauge of chipmakers gains 1.1 per cent. And the Russell 2000 Index rises 0.5 per cent, remaining on track to top the S&P 500 for an 11th straight session.

Hassett had been seen as a top contender to succeed current Fed Chair Jerome Powell. However, at a White House event, Trump said he would like for Hassett to remain as director of the National Economic Council.

“If I had to pick between the two Kevin’s, I’d go with Hassett over Warsh,” said Renaissance Macro Research’s Neil Dutta. “So crushing Hassett only helps Warsh. We know that Kevin Warsh has been hawkish his entire career. He hates inflation even when it is running below the Fed’s target.”

Dutta notes that Warsh would be an “interesting choice” due to Trump’s policy views.

“Markets aren’t stupid and know Warsh is only changing his views now to accommodate the President,” said Dutta. “That’s why the long end is rising.”

Mid-Cap Mania

While it has been an up-and-down week for the S&P 500 and Nasdaq 100, the Russell 2000 has continued to impress. The gauge has managed to beat the S&P 500 over 10 straight sessions, its longest streak since 2008.

“There’s a new king of the hill to start 2026,” said Brian Jacobsen, chief economic strategist at Annex Wealth Management. “Instead of large‑cap growth, small‑cap value is taking the crown. After years of head‑fakes — moments when it seemed

big‑cap tech’s dominance

might finally give way to broader market participation —

the long‑anticipated ‘Great Rotation’

may finally be taking shape.”

Mid-cap stocks have had a strong start to the year globally, according to XTB’s Kathleen Brooks, who noted that there were several reasons why the firm liked the cohort, including tech risks. Brooks points to the performance of Sandisk Corp. and the semiconductor sector more broadly as a sign that the concentration risk is “real” for blue-chip stocks again this year.

“If investor enthusiasm for the AI trade sours, then the S&P 500 could sell off sharply,” said Brooks. “In contrast, there is a broader group of top performers on the Russell 2000, for example, the top performing sectors include basic materials, energy and telecoms. Tech is only the fourth top performing sector.”

Brooks adds that the top performing stock on the Russell 2000 year-to-date through Thursday’s close — pharmaceutical firm Erasca Inc. — has potential to be resilient should the tech trade unwind.

Regional Bank Earnings

With

big bank

earnings out of the way, other names in the space took centre stage to report. Regional bank PNC Financial Services Group Inc. advanced 4.2 per cent after reporting an increase in fourth-quarter revenue. The metric

beat consensus expectations

as financing and dealmaking by middle-market customers accelerated.

Meanwhile, Regions Financial Corp. dropped after earnings per share and total loans in the fourth quarter missed the average analyst estimate. The regional bank also received a downgrade at Wells Fargo following the print. Shares in State Street Corp. also declined following results. The trust bank told investors it sees year expenses being up three per cent to four per cent, and also expects net interest income to be up low-single-digits percentage.

Other notable movers include JB Hunt Transport Services Inc., which fell after fourth-quarter revenue missed estimates, extending the ongoing freight slump.

Looking ahead to next week, Wells Fargo Investment Institute’s Doug Beath said investors will have “more time to digest the significant geopolitical events and policy announcements from this past week and may not be so sanguine, which could bring about more volatility,” he said.

Bloomberg.com

Market pares gain as Trump wavers on Hassett as Fed chair pick

2026-01-16 15:17:47