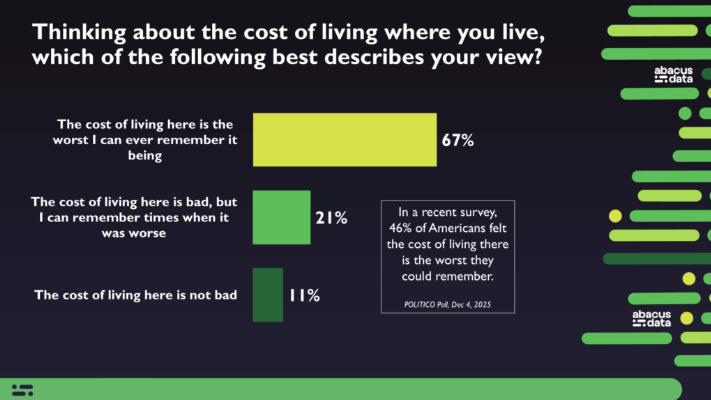

If you’re feeling like the cost of living is pinching you more than ever before, you’re not alone, according to new research from Abacus Data.

A whopping 67 per cent of Canadians believe the cost of living where they live is the worst it has been in memory, while another 21 per cent believe it’s bad, but remember a worse time. Just 11 per cent don’t believe the cost of living is bad at the moment.

“This is not a marginal concern or a background anxiety,” David Coletto, chief executive of Abacus Data,

said in a report.

“It is a dominant lived experience that continues to shape how Canadians interpret government performance, leadership and competing policy priorities, alongside concern about Donald Trump, trade and global instability.”

Despite the concerns, the cost of living appears to be stabilizing. Inflation in November held steady at 2.2 per cent, Statistics Canada said on Monday, bringing the yearly average to a bit higher than the Bank of Canada’s target of two per cent.

Meanwhile, housing prices in many parts of Canada are on the downswing, with prices falling two per cent in November, according to the Canadian Real Estate Association.

Still, the cost of living was among the top three political concerns for 62 per cent of Canadians and was the top issue in every region of the country.

That said, the definition of affordability varies depending on who you are. Housing is the major pressure on the cost of living for about 60 per cent of younger Canadians, compared to less than 40 per cent of those aged 60 and over.

Affordability for 93 per cent of older Canadians mostly comes down to food prices.

“Messages that treat the cost of living as a single problem risk missing the specific pressure points that different audiences feel most acutely,” Coletto said.

Canadians have a right to be concerned with food prices. The price of food purchased in store climbed 4.7 per cent year over year in November, the fastest pace in two years and more than double the overall inflation rate.

The biggest drivers of food prices in the month were beef, up 17.7 per cent, and coffee, up 27.8 per cent.

Overall, the average family of four can expect to pay about $1,000 more for food in 2026 than it did this year, according

to Canada’s Food Price Report 2026.

People may be more concerned about affordability in the coming months as the holiday bills come in, and Coletto recommends government officials show some empathy as people feel the pinch.

Sign up here to get Posthaste delivered straight to your inbox.

Canada is seeking help from China to curb the traffic of fentanyl from crossing borders, a common gripe of U.S. President Donald Trump.

Trump has used fentanyl to defend imposing tariffs on Canada and Mexico, though it is being challenged in the U.S. Supreme Court.

Only a fraction of fentanyl that enters the U.S. flow in through Canada, but Prime Minister Mark Carney has named Kevin Brosseau the government’s fentanyl czar to slow it further.

Prime Minister Mark Carney is scheduled to visit with Chinese President Xi Jinping in 2026.

Read more here.

- Today’s Data: International securities transactions for October, U.S. retail sales for November

- Earnings: BHP Group Ltd., Organigram Global Inc.

- Newfoundland’s bet on offshore oil comeback could hinge on ‘close-call investment’

- CRA’s 100-day plan results are not the presents Canadians want or need

- Teck moves one step closer to merger with Anglo American after federal approval

- What is quantum computing and can Canada remain a hotbed for the futuristic technology?

Often, bankruptcy is a last resort and while it can offer a financial restart, for some it simply isn’t a practical option. Many debts can survive a bankruptcy, such as mortgage debt, student loans and court ordered fines. Bankruptcy can also lead to challenges in your professional life. Anyone considering bankruptcy should seek professional advice to find out what kind of options may be available.

Read more here.

Interested in energy? The subscriber-only FP West: Energy Insider newsletter brings you exclusive reporting and in-depth analysis on one of the country’s most important sectors.

Sign up here.

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you starting out or making a change and wondering how to build wealth? Are you trying to make ends meet? Drop us a line at

wealth@postmedia.com

with your contact info and the gist of your problem and we’ll find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course).

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus, check out his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Ben Cousins, with additional reporting from Financial Post staff, Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: Feel like the cost of living is at its worst? You’re not alone

2025-12-17 13:00:19