Warnings of a bubble have been gathering steam at an alarming pace lately as the restless rally of U.S. stocks continues.

Since April, the

S&P 500 has climbed

35 per cent in one of the best runs since the 1950s, despite a worrying backdrop of trade and geopolitical tensions and ballooning government debt.

It has started to make everyone from the Bank of England to Jamie Dimon nervous.

The

International Monetary Fund

weighed in with a warning last week: “Financial stability risks remain elevated. Valuation models show risk asset prices well above fundamentals, raising the risk of sharp corrections.”

How sharp a correction? In an

article for The Economist

that warned the world was becoming dangerously dependent on American stocks, former IMF chief economist Gita Gopinath said equity enthusiasm around

artificial intelligence

is being compared to the dot-com boom in the late ’90s. When that crashed from 2000 to 2002 it wiped out US$5 trillion in market cap.

She estimates that a correction of that magnitude today would wipe out over US$20 trillion in American household wealth, equivalent to about 70 per cent of the United States’ gross domestic product in 2024.

The impact would be felt around the world, including in Canada where i

nvestors have piled into U.S. stocks

and bonds at an unprecedented rate this year.

Royce Mendes, head of macro strategy at Desjardins Group, said while such a correction would hurt Canadians, the economic fallout would not be as severe here as it would south of the border.

He estimates that a stock correction on the magnitude of the dot-com bust would erase the equivalent of about 45 per cent of GDP off Canadian household wealth.

The reasons for this are that Canadian portfolios tend to have a bias to domestic equities which are less exposed to the tech sector, and Canadian households hold a smaller share of their wealth in publicly listed equities, he said.

“Canadians tend to access fixed income through mutual funds, whereas Americans more often hold bonds directly,” he said.

But before we get smug about it, Mendes cautions that though Canadians are less vulnerable to a stock correction they are heavily invested in another risky asset class.

Real estate accounts for about 40 per cent of household assets in Canada, compared with 25 per cent in the United States and over the past two years values have been dropping.

“Falling home prices in many provinces have constrained wealth accumulation in Canada,” Mendes said, with household wealth rising just 7 per cent since 2022, compared to the 16 per cent gain by American households.

It’s something the

Bank of Canada

should keep an eye on, he said.

“Most homeowners still have substantial equity, but that cushion is shrinking each month,” he said.” After several years of declines, stabilizing house prices should be a priority for monetary policymakers aiming to restore the economy to full health.”

Sign up here to get Posthaste delivered straight to your inbox.

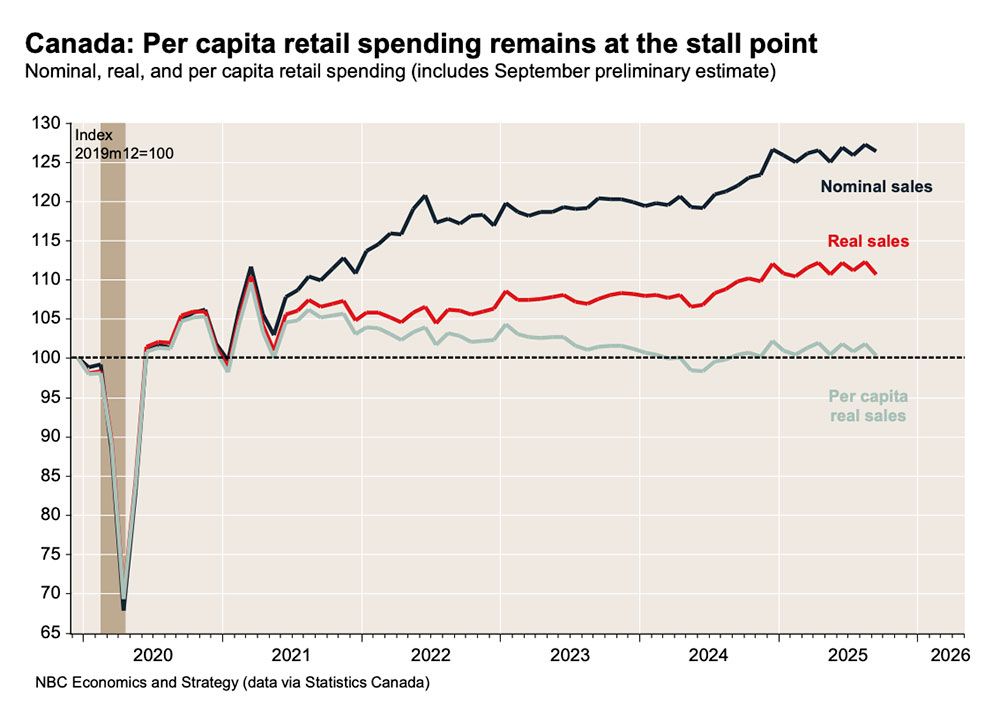

Canada’s

retail sales rose

in August but then likely slumped in September in a roller coaster that could weigh on the economy’s growth in the third quarter, warn economists.

Auto sales were the big driver of the August rebound, but if they are excluded spending rose just 0.7 per cent, well below forecasts, said National Bank of Canada economist Kyle Dahms.

Statistics Canada estimates September sales fell by 0.7 per cent and as today’s chart shows, spending per capita, or per person, has been flatlining for a while.

- Prime Minister Mark Carney attends the ASEAN summit in Malaysia, as part of a nine-day trip to the region

- Today’s Data: United States September inflation data

- Earnings: Procter & Gamble Co., General Dynamics Corp.

- Canada’s electric vehicle supply chain is fading. Will dreams of making the country an EV powerhouse survive?

- TFSA overcontributions get thousands of Canadian taxpayers in trouble with CRA, new data show

- Look out for these key signs of a stock market bubble

Overcontributions to tax-free savings accounts (TFSA) continue to be a big problem for thousands of Canadians, as well as a source of increasing tax revenue for the Canada Revenue Agency (CRA) as it relentlessly pursues the collection of penalty tax in the courts. Tax expert Jamie Golombek runs through the rules and the penalties.

Read on

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: Why Canada would fare better than America if the stock 'bubble' bursts

2025-10-24 12:06:48