Canadian consumers appear to be hanging in there after fourth-quarter

retail sales

rose 0.1 per cent — a seventh consecutive quarterly increase — despite falling 0.4 per cent month over month in December.

In 2025, retail sales increased four per cent year over year, led by gains at motor vehicle and parts dealers. Sales volumes rose 2.3 per cent.

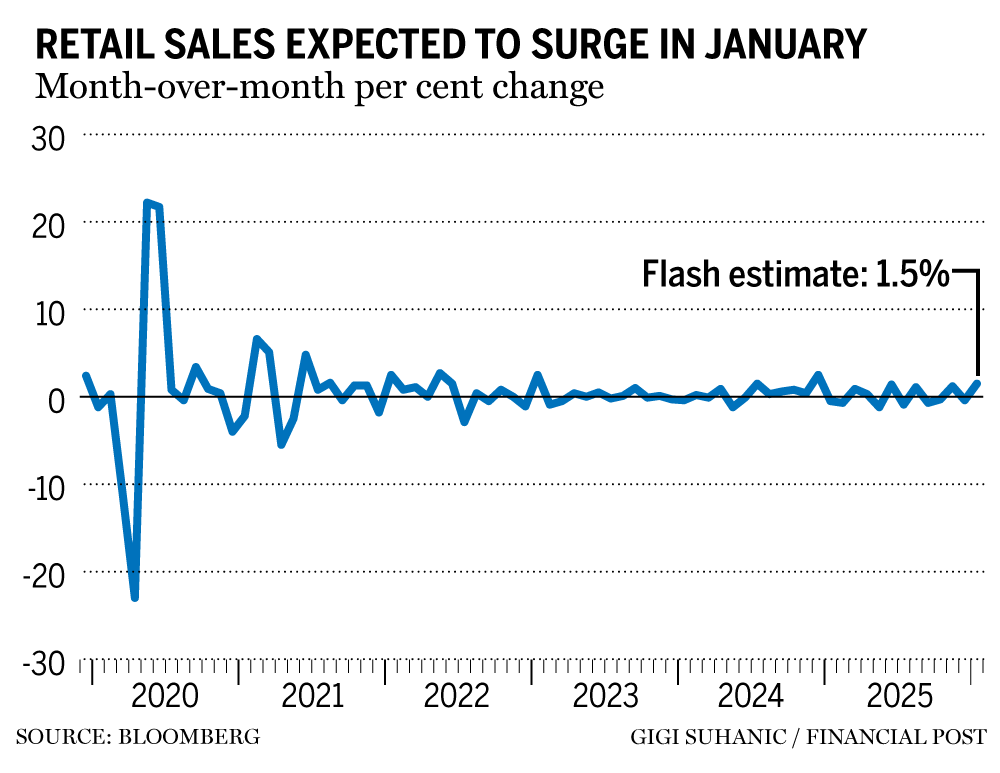

Statistics Canada estimated

retail sales jumped 1.5 per cent in January.

“Ultimately, consumer spending is holding on despite ongoing economic uncertainty,” Shelly Kaushik, an economist at BMO Economics, said in a note, adding that the January estimate “would mark the strongest pace since 2024.”

The declines in December were concentrated in three of the nine sectors covered:

building materials, furniture and electronics and auto sales. Those were offset by gains in gasoline, sporting goods, hobbies and books, and health and personal care.

“Retail sales have been quite volatile in recent months, affected by the elevated uncertainty, the drop in consumer confidence earlier this year and the lack of improvement in purchasing power in recent years,” Charles St-Arnaud, chief economist at Servus Credit Union, said in a note.

For example, retail sales pulled back in December after rising 1.2 per cent in November, but most economists said that retail sales adjusted for inflation have been “moving sideways.”

St-Arnaud said retail sales adjusted for slowing population growth and inflation came in flat in December and rose 1.7 per cent from the same time last year.

He said relatively “level” sales during 2025 speak to consumers’ resiliency, especially going into 2026, which could help support

gross domestic product

in the first quarter and offset weak business investment and slowing exports.

Some economists are less optimistic about consumers’ resiliency.

“We continue to expect consumer outlays in (the first quarter) will grow only modestly,” Tony Stillo, head of Canada Economics at Oxford Economics Ltd., said in a note.

He said the retail sector will be hit by a declining population, job insecurity due to the ongoing trade war, “modest” job losses and another wave of mortgage renewals at higher

interest rates.

But the federal grocery and essentials benefit could provide a boost by mid-year, he said.

David Rosenberg, president of Rosenberg Research & Associates Inc., said in a note that “cyclically sensitive expenditures” sagged after stripping out essentials such as personal care items, food and gasoline.

He said disinflation was also evident, given that retailers cut their prices by 0.3 per cent month over month.

Statistics Canada will release its fourth-quarter gross domestic product data next week and economists expect the flat retail volumes are indicative of a likely weak result.

Strong retail sales in November and the January flash estimate suggest consumer spending is poised to pick up, Andrew Grantham, an economist at CIBC Capital Markets, said in a note.

“If that is the case, it justifies the current on-hold stance from the

Bank of Canada

, although we will need a few more months of data to confirm if this upward trend will hold,” he said.

But others point out the January estimate, if it holds, is just one month’s worth of data.

“I

t will take a few more months of data to judge if the January figure is the start of a new uptrend,” Grantham said.

Rosenberg also wondered how well the flash estimate will hold up.

“The veracity of that number can certainly be called into question, given that we know that the economy lost 25,000 jobs last month,” he said.

Rosenberg also thinks the retail sector has fallen into a recession based on two consecutive annualized declines in the third and fourth quarters.

“Disinflationary momentum to this extent should be opening the door for the Bank of Canada to give the domestic economy the relief it desperately needs,” he said.

• Email: gmvsuhanic@postmedia.com

Canadian consumers were 'holding on' in December despite economic uncertainty

2026-02-20 18:08:59