Mortgage delinquencies

are on the rise in Canada,

Canada Mortgage and Housing Corp.

(CMHC) said in a

new report

, and they could get worse with one million mortgages up for renewal this year.

The Bank of Canada expects

60 per cent of mortgage holders

who are renewing this year will wind up paying more — six per cent on average — but the increases could be as much as 15 per cent to 20 per cent for a five-year fixed mortgage, which is the most popular type among Canadians.

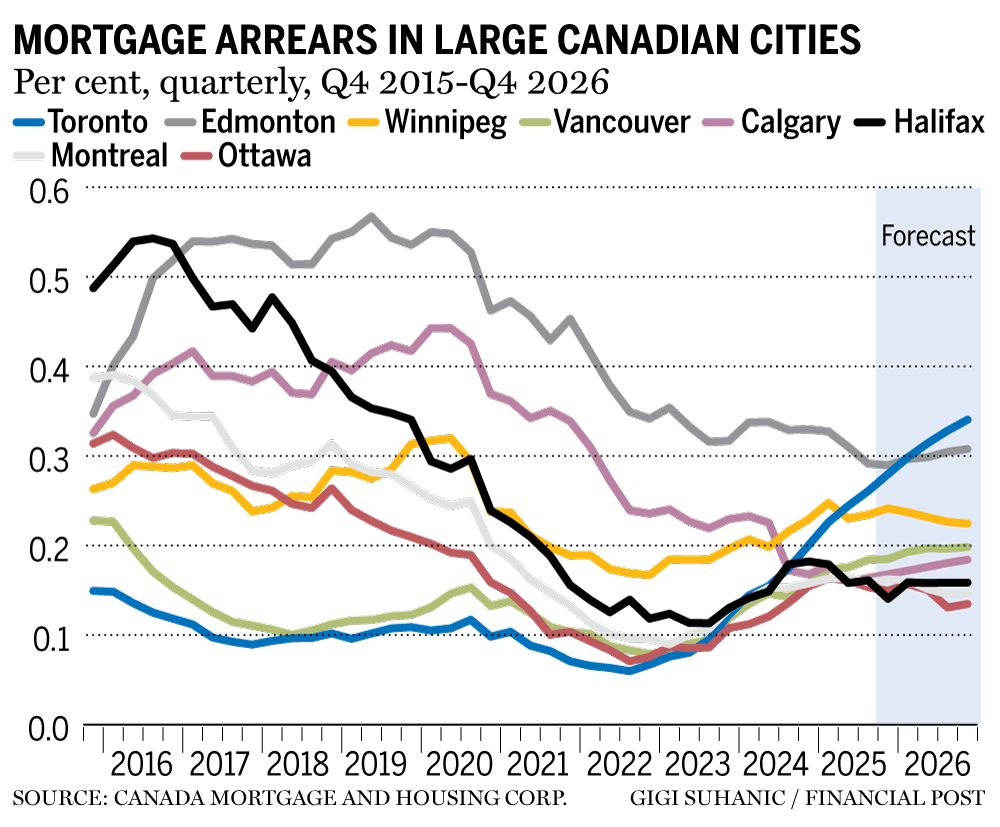

“The national mortgage arrears rate — the share of mortgage consumers who have missed payments for 90 days or more — has been increasing,” CMHC said in a report released on Thursday, citing a “significant” increase of seven basis points from the third quarter of 2023 to the third quarter of 2025.

The national housing agency said the delinquency story is one of geography and demographics, with major cities such as

Toronto

and

Vancouver

recording the highest levels of delinquencies and those who purchased a home during the pandemic exhibiting the greatest signs of payment stress.

For example, mortgage delinquencies since 2022 have more than quadrupled in

Toronto

. Alongside higher payments, homeowners in the city are grappling with greater levels of

household debt

due to elevated real estate costs, while individual real estate investors face rising costs and falling rents. Falling

home prices

and

slowing sales

and a weak

job market

are also hampering people’s ability to cope with rising mortgage payments.

Fresh

jobs

numbers out Friday pegged Ontario’s unemployment rate at 7.3 per cent compared with the national average of 6.5 per cent as the province’s manufacturing sector continues to take blows from tariffs.

Some of these stressors look like they’re here to stay, at least for 2026. The

Toronto Regional Real Estate Board

(TRREB) on Wednesday said it expects more home price declines in the first half of this year. It also said sales in December fell 20 per cent from a year ago.

“Delinquency pressures in the GTA are expected to remain elevated throughout 2026,” CMHC said.

Mortgage arrears are also rising steadily in Vancouver, though at a slower pace than in Toronto, due to rising costs and “weaker resale conditions.”

Other cities facing “moderate” delinquency risk include

Calgary

and, to a greater degree, Edmonton, where the job market is more “sensitive.”

Homebuyers

who have high levels of housing debt to equity after purchasing during the pandemic are the most at-risk group.

“When renewing their mortgages for the first time, they face a sharp increase in interest rates on already high debt levels, which places significant strain on their budgets,” CMHC said.

Arrears are rising at the fastest pace among buyers who purchased between 2020 and 2021 and 2022 and 2024, according to Equifax Inc. data, proof of how vulnerable they are to rates that are now much higher than when they took out their mortgage.

Meanwhile, the costs of mortgage debt outpaced the increase in value of real estate in the third quarter, according to Statistics Canada’s latest household wealth survey.

The CMHC also said the number of high-risk borrowers is growing, while debt is rising the fastest among those who are most likely to miss a mortgage payment.

At this point, delinquency levels are still historically low, but the housing agency is forecasting for them to rise to pre-pandemic levels.

It also said the trends “indicate that more households may be becoming overstretched as they adjust to higher interest rates and the rising cost of living. This highlights growing financial vulnerability.”

TFSA vs. RRSP: A wealth-building series from the Financial Post

It’s one of the most important — and sometimes confusing — savings decisions Canadians face, and the right answer depends on far more than a simple rule of thumb. This week, the Financial Post is running a series called TFSA vs. RRSP, breaking down the key questions in deciding between the two accounts, including mistakes to avoid and how to get the most bang for your buck. Check here every day for the latest.

Sign up here to get Posthaste delivered straight to your inbox.

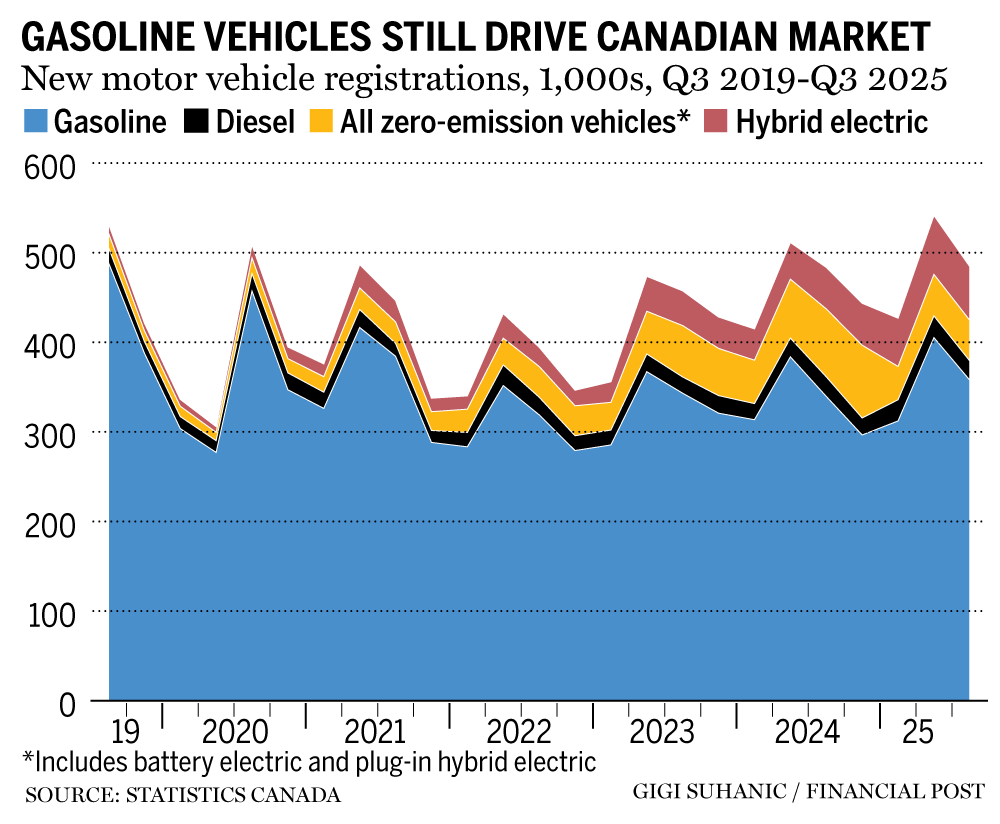

Prime Minister Mark Carney says he’s delaying the timeline for the electric vehicle transition by about five years and unveiled several other auto policies Thursday, including the return of the $5,000 incentive for buying an EV.

The new automotive strategy cancelled a federal policy, colloquially known as the EV mandate, that would have required automakers to produce and sell only electric vehicles by 2035. Instead, the government plans to draft new rules by year-end that will set Canada on a path to achieve 75 per cent EV adoption by 2035 and 90 per cent by 2040 by focusing on greenhouse gas emission reductions so automakers can still produce internal combustion engine vehicles as long as their overall emissions fall. — Gabriel Friedman, Financial Post

Read the full story here.

- Today’s Data: Statistics Canada releases January job numbers. University of Michigan consumer sentiment index for January

- Earnings: Canopy Growth Corp., Under Armour Inc., Philip Morris International Inc.

- Could a memory chip ‘bottleneck’ cause laptop and phone prices to go through the roof?

- Fate of Canadian economy will depend on how we adapt to structural changes, Macklem says

- Canadian pension funds to exit U.K.’s biggest port operator in $18.5 billion deal

Interested in energy? The subscriber-only FP West: Energy Insider newsletter brings you exclusive reporting and in-depth analysis on one of the country’s most important sectors.

Sign up here.

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you starting out or making a change and wondering how to build wealth? Are you trying to make ends meet? Drop us a line at

wealth@postmedia.com

with your contact info and the gist of your problem and we’ll find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course).

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus, check out his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Gigi Suhanic, with additional reporting from Financial Post staff, Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: Mortgage delinquencies more than quadrupled in this Canadian city with no relief on the horizon

2026-02-06 13:00:01