Canada’s wealthiest

appear to be much more tightfisted than their American counterparts, possibly denying the economy a powerful source of growth, says one economist.

The United States is experiencing what economists have dubbed a K-shaped economy spurred by its wealthiest citizens, who are on a spending spree fuelled by soaring stock markets, while lower-income groups tighten their wallets amid apparent rising financial stress.

The U.S. economy grew at an annualized rate of 4.4 per cent in the fourth quarter, according to advance data, far outpacing

Canada’s 2.6 per cent growth

in gross domestic product (

GDP

) in the third quarter — the most recent numbers available. Economists expect Canada’s GDP for the final quarter of 2025 to come in flat.

Unlike Americans, however, Canadians with the most financial assets appear intent on hanging onto their cash, according to Statistics Canada’s

household wealth survey

released on Thursday.

Households with the highest income increased their net savings by 6.7 per cent in the third quarter — the highest among income groups — as work and investment earnings topped their increases in spending.

The average

savings rate

for all income groups shrank in the third quarter as spending on basic items, such as housing, utilities, insurance and financial services, and transportation and storage, outstripped weak increases in wages.

Canada’s higher-income earners are exhibiting “seemingly cautious behaviour,” Andrew Grantham, an economist at CIBC Capital Markets, said in a note.

Income gains among Canada’s wealthiest have been “less pronounced than in the U.S.,” he said, but “this income group has indeed seen stronger income and wealth gains relative to other households in recent years. Yet spending has been comparatively modest.”

The highest income group had an average of $195,337 in disposable income and accounted for nearly two-thirds of Canada’s net worth. Their net worth averaged $3.5 million per household after it increased at the fastest pace in the third quarter due to investments that grew by 10.6 per cent. Their average mortgage costs rose 2.1 per cent, “the lowest rates of any wealth group,” Statistics Canada said.

By comparison, the next highest-income group had nearly $110,000 of disposable income. The lowest group had a disposable income of $28,161.

Grantham said the wealthiest’s current lack of spending is due to a few factors.

“This could just be a timing issue,” he said, given the rise in

Canadian equities

last year after lagging the U.S. market.

“It could also reflect conservatism towards spending given ongoing trade uncertainty, and accumulated savings could possibly be spent if that fades.”

Grantham also said Canadians are more sensitive to

interest rates

than Americans. For example,

mortgage rates

in Canada typically reset every five year, while mortgage rates in the U.S. are often fixed for 30 years.

It’s estimated that as much as 60 per cent of the outstanding mortgages in Canada this year will be renegotiated at higher interest rates.

Canadians earning more than $100,000 fear they will miss a mortgage debt payment in the next year, Grantham said, citing a finding in the Bank of Canada’s latest Consumer Outlook Survey.

As a result, Canadians shouldn’t look for any K-type spending to help out the economy.

“The lack of a ‘K’ in Canada may also not be particularly surprising, given that high earners here have incomes and wealth that aren’t quite as extreme relative to other groups as those seen south of the border,” Grantham said. “However, digging a bit deeper shows that it may not be OK that we aren’t seeing a ‘K’ in consumer spending here in Canada.”

Sign up here to get Posthaste delivered straight to your inbox.

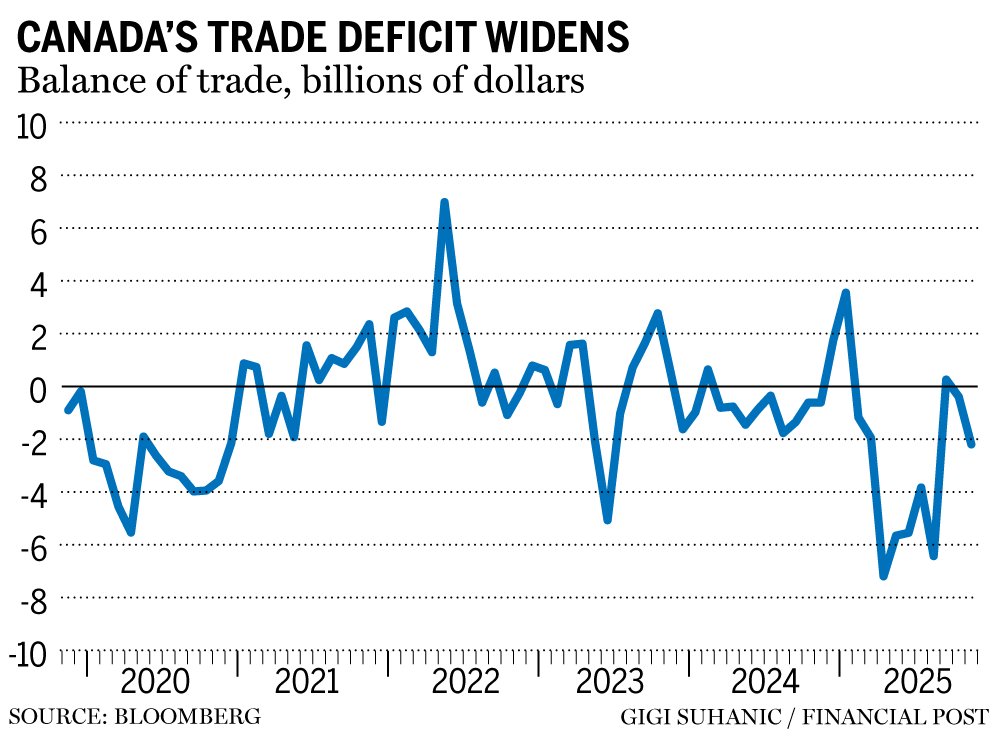

Canada’s trade deficit widened by more than expected as volatile gold shipments fell and both exports and imports of motor vehicles and parts decreased.

The country’s trade shortfall was $2.2 billion in November, Statistics Canada reported Thursday. Economists surveyed by Bloomberg were expecting imports to exceed exports by $690 million. — Bloomberg

Read the full story here.

- Today’s Data: Canadian GDP for November, U.S. producer prices for November

- Earnings: Imperial Oil Ltd., Canadian National Railway Co., Brookfield Renewable Partners, Brookfield Business Partners LP, Exxon Mobil, American Express Corp., SoFI Technologies Inc.

- GM axes third shift at Oshawa plant, laying off hundreds of workers

- What’s going on with the greenback? Why all eyes are on the sinking U.S. dollar as Trump starts second year

- How ordinary investors can tap into the gold and silver boom

If you have a severe hearing impairment, you may be entitled to claim the

disability tax credit

(DTC). The DTC is a non-refundable tax credit that is intended to recognize the impact of various non-itemizable disability-related costs. For 2025, the value of the federal credit was $1,470 but add the provincial tax savings and the combined annual value can be more than $3,200, depending on your province of residence. The DTC is also a requirement to qualify for opening a registered disability savings plan (RDSP). Keep reading Jamie Golombek

here

to find out more about the disability tax credit, how to qualify and why the CRA denied a hearing-impaired person’s claim.

Interested in energy? The subscriber-only FP West: Energy Insider newsletter brings you exclusive reporting and in-depth analysis on one of the country’s most important sectors.

Sign up here.

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you starting out or making a change and wondering how to build wealth? Are you trying to make ends meet? Drop us a line at

wealth@postmedia.com

with your contact info and the gist of your problem and we’ll find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course).

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus, check out his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Gigi Suhanic, with additional reporting from Financial Post staff, Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: Canada's wealthiest are hanging onto their cash and that's too bad for the economy

2026-01-30 13:00:42