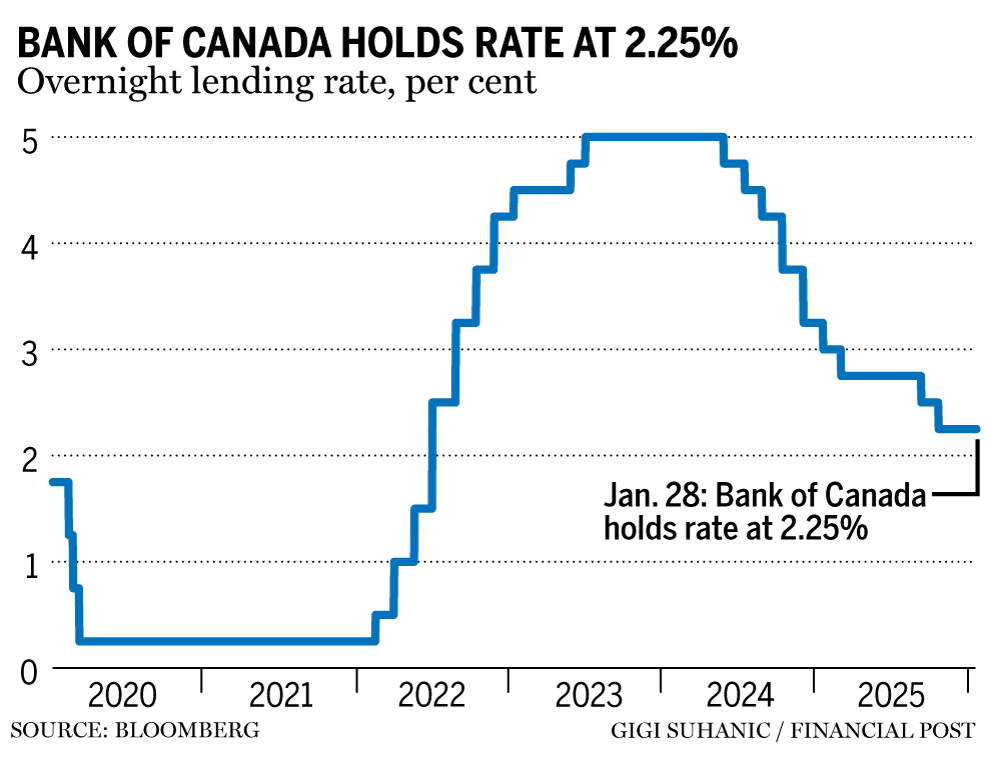

The Bank of Canada held the overnight interest rate at 2.25 per cent on Wednesday, but remains prepared to respond should the outlook change.

“Governing council judges the current policy rate remains appropriate, conditional on the economy evolving broadly in line with the outlook we published today,” said Bank of Canada

Tiff Macklem

. “With heightened uncertainty, we are monitoring risks closely.”

Macklem said it’s too early to tell how well the Canadian economy is adjusting to the new trade environment. The governor added that a large source of uncertainty to the outlook is the upcoming review of the

Canada-United-States-Mexico Agreement (CUSMA)

this year.

“Considering both our baseline forecast and the risks, governing council discussed the future path of monetary policy,” said Macklem. “While council judges the current policy rate is appropriate based on our outlook, the consensus was that elevated uncertainty makes it difficult to predict the timing or direction of the next change in the policy rate.”

The central bank’s monetary policy report projects

gross domestic product (GDP)

growth will come it at zero for the fourth quarter of 2025, driven by an expected pullback in business inventory investment. GDP growth for last year is now expected to have been 1.7 per cent, up from 1.2 per cent in the October projections. GDP growth is expected to remain modest over the projection horizon, with 1.1 per cent growth in 2026 and 1.5 per cent growth in 2027. Overall, the economic outlook remains broadly consistent with the projections outlined in October.

Canada’s

inflation rate

rose to 2.4 per cent in December, driven by base-year effects linked to last winter’s GST/HST holiday. CPI inflation is projected to be two per cent in 2026 and 2.1 per cent in 2027. The central bank said measures of core inflation eased from three per cent in October to 2.5 per cent in December.

The bank said

U.S. tariffs

will continue to drag on business investment in 2026 and have already had an impact on the Canadian labour market. The Canadian economy has added 190,000 jobs since August, but the unemployment rate remains elevated at 6.8 per cent. Job vacancies have fallen to their lowest since October 2017.

“Employment weakened in the first half of 2025 as sectors hit hard by U.S. tariffs cut production and jobs,” Macklem said. “In recent months, overall employment has risen, led by hiring in services like health care, and slowing population growth is reducing the number of new entrants into the labour market.”

Fiscal policy is expected to have a modest impact on growth over the projection horizon.

“Government spending on infrastructure is projected to rise, mainly reflecting commitments in provincial budgets,” the report said. “Additional federal capital transfers will also bolster infrastructure investment.”

U.S. tariffs have had a significant negative impact on Canadian exports. While the push for trade diversification is welcome, the expansion of exports is expected to be modest over the next two years.

“This restructuring, including more diversified trade and a more integrated internal market, will support some recovery in our productive capacity,” Macklem said. “But it will take some time.”

As outlined in its MPR, the top risk to the outlook is the CUSMA review. The bank highlights that Canada currently has an effective U.S. tariff rate of 5.8 per cent, thanks to the exemptions under the North American trade pact. It warned that an unfavourable outcome to negotiations could make Canadian exports less competitive.

“Faced with weaker demand, exporters would reduce production, investment and hiring,” the report said. “This would spill over into the broader economy, weighing on sectors such as services and putting Canadian GDP on a lower path.”

• Email: jgowling@postmedia.com

Bank of Canada holds interest rate at 2.25%, but is 'monitoring risks closely'

2026-01-28 14:45:18