Global tensions have been running high after United States President

Donald Trump

threatened eight European countries with

tariffs

— 10 per cent to start and 25 per cent later — if he didn’t get his way on

Greenland

.

Stock markets

plummeted around the world, while the VIX, known as Wall Street’s “fear index,” jumped like it did in the wake of Trump’s Liberation Day tariffs.

However, stocks bounced back after Trump recanted on taking Greenland by any means necessary and on the EU tariff threat, once again playing to the Trump Always Chickens Out (TACO) narrative,

David Rosenberg

, founder of Rosenberg Research & Associates Inc., said.

“The fact that Donald Trump has called off tariffs on Europe over Greenland, citing a ‘framework of a future deal’ that will involve mineral rights and missile defence, triggered a sharp bounce-back in the world equity markets,” he said in a note on Thursday.

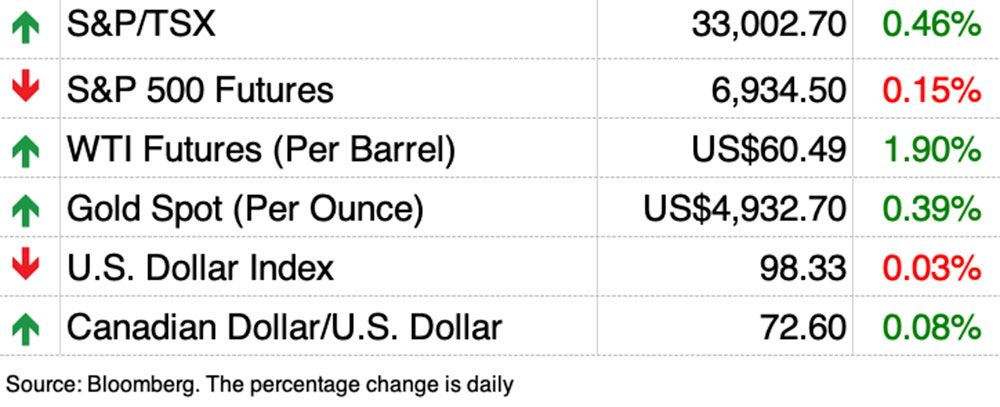

Investor relief could be seen across a whole swath of metrics.

“Measures of implied volatility in Treasury, equity and foreign exchange markets are all coming down,” Karl Schamotta, chief market strategist at Corpay Inc., said in a note.

Investors reduced their protections against currencies such as the

Canadian dollar

and the Australian dollar, which he said are more sensitive to risks.

Prior to the latest TACO, yields on long-term U.S. Treasuries had risen, but Rosenberg said they have since pulled back. Rising long-term yields indicate that investors are pricing in more future risks.

Markets had more to celebrate than just diffused tensions over Greenland, Rosenberg and Schamotta said.

On Wednesday, the

U.S. Supreme Court

heard arguments over whether the government could temporarily fire U.S.

Federal Reserve

governor Lisa Cook while a separate court case against her goes on.

Washington has alleged that Cook falsified mortgage documents by listing different addresses as a principal residence, which it said was grounds for her immediate dismissal without giving her the chance to defend herself.

However, Schamotta said the tone of questioning from the

Supreme Court

justices suggests they took “a dim view of the Trump administration’s attempt to fire a sitting Fed governor,

lowering the threat level for a central bank that has historically been insulated against political interference.”

He pointed to the questioning of U.S. officials by Justice Brett Kavanaugh, a Trump appointee, who said letting a president pre-emptively fire a governor would “weaken or shatter” the independence of the Fed.

Rosenberg also interpreted the events at the court as hostile to the case against Cook.

“The body language narrative out of the Supreme Court strongly suggests that the president will end up losing the Lisa Cook case (and implications for any further such interference at the Fed) and has added to the positive investor tone,” he said.

Another threat overhanging the Fed is the U.S. Department of Justice’s probe against Fed chair

Jerome Powell

into the finances around the renovation of the central bank’s headquarters in Washington, D.C.

Markets and the economy depend on an independent Fed to maintain price stability and

inflation

, which it does by adjusting

interest rates

as needed.

Trump has been haranguing Powell to cut rates faster despite what the data is telling officials about inflation and the U.S. job market.

“It’s having a series of effects across financial markets: it’s helping to depress short-term yields, it’s pushing up long-term yields and it’s weighing on the U.S. dollar relative to all its major rivals,”

Schamotta said in an interview

with Financial Post’s Larysa Harapyn.

Derek Holt, vice president of capital market economics at Bank of Nova Scotia, said the markets have already tuned out the Cook case on the “assumption that the court will reject attempts to have her dismissed before her case has fully played out.”

With Greenland and Cook on the back burner, “it’s back to the fundamentals,” he said.

Sign up here to get Posthaste delivered straight to your inbox.

- Today’s Data: Canada retail sales for November, U.S. S&P global manufacturing PMI, January U.S. economic survey, University of Michigan consumer sentiment, Kansas City Fed services activity.

- Is it time to ‘sell America’? Why financial retribution comes with plenty of risk

- Canada’s nuclear fusion company is going public on the Nasdaq

- Vegas resort chain to take Canadian dollars at par in bid to lure back travellers

Non-compliance in the real estate sector continues to be an area of concern for the Canada Revenue Agency. In late November 2025, the CRA released the results of the agency’s real estate audit activities for the 2024-2025 fiscal year, which show that a total of 14,854 audits were completed between April 2024 and March 2025, up 2,100 from the prior year. These audits led to a total of $849 million in taxes and penalties, up from $648.5 million the prior year. Read more here on the 10 ways the CRA could audit you on real estate.

Interested in energy? The subscriber-only FP West: Energy Insider newsletter brings you exclusive reporting and in-depth analysis on one of the country’s most important sectors.

Sign up here.

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you starting out or making a change and wondering how to build wealth? Are you trying to make ends meet? Drop us a line at

wealth@postmedia.com

with your contact info and the gist of your problem and we’ll find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course).

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus, check out his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Gigi Suhanic, with additional reporting from Financial Post staff, Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: Stock markets digest another TACO in high-wire week that leaves world breathing easier — for now

2026-01-23 13:00:37