The Canadian financial sector’s record results in 2025 despite

United States President Donald Trump

‘s tariffs and geopolitical shocks may have surprised many economists and analysts, but not Peter Miller, head of Equity Capital Markets at Bank of Montreal.

“Despite all the headlines, most Canadian companies were/are still able to export to the U.S. with zero or minor tariffs due to exemptions set by the U.S.,” he said, referring to how the

Canada-U.S.-Mexico Agreement (CUSMA)

helped shield this country from the worst of Trump’s tariffs.

The industries most heavily hit by tariffs, such as steel, aluminum, auto and lumber, comprise a small percentage of the public market capitalization in the Canadian public equity market, Miller said.

What surprised him, though, was how well the secondary market — where investors buy and sell previously issued securities and assets among themselves rather than from the original issuing entity — performed.

For example, three of the top five ownership equity deals in 2025 were secondary offerings:

Restaurant Brands International Inc.

raised 1.7 billion in November, and

GFL Environmental Inc.

raised $1.29 billion and $1.06 billion in March and November, respectively.

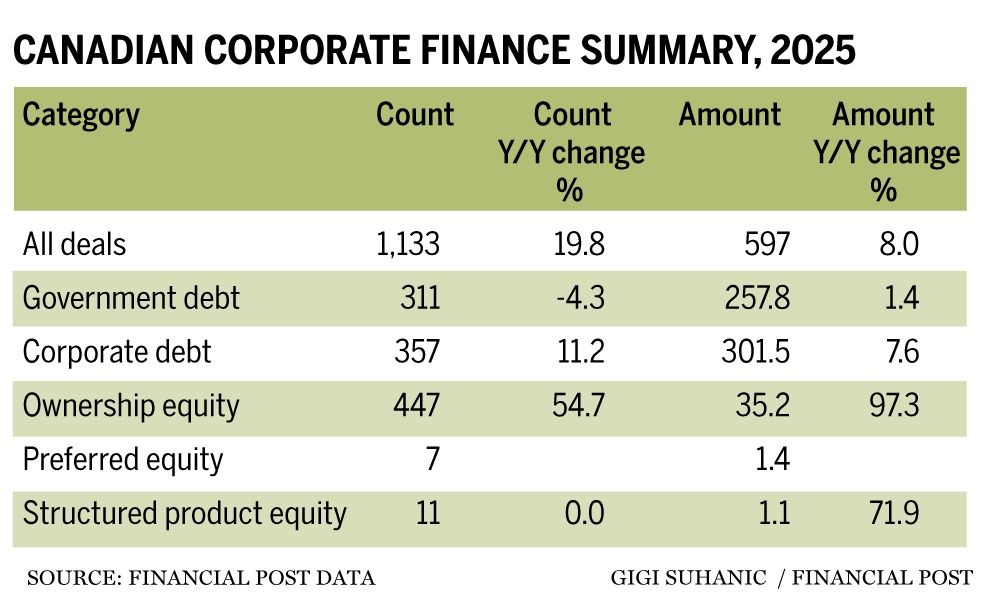

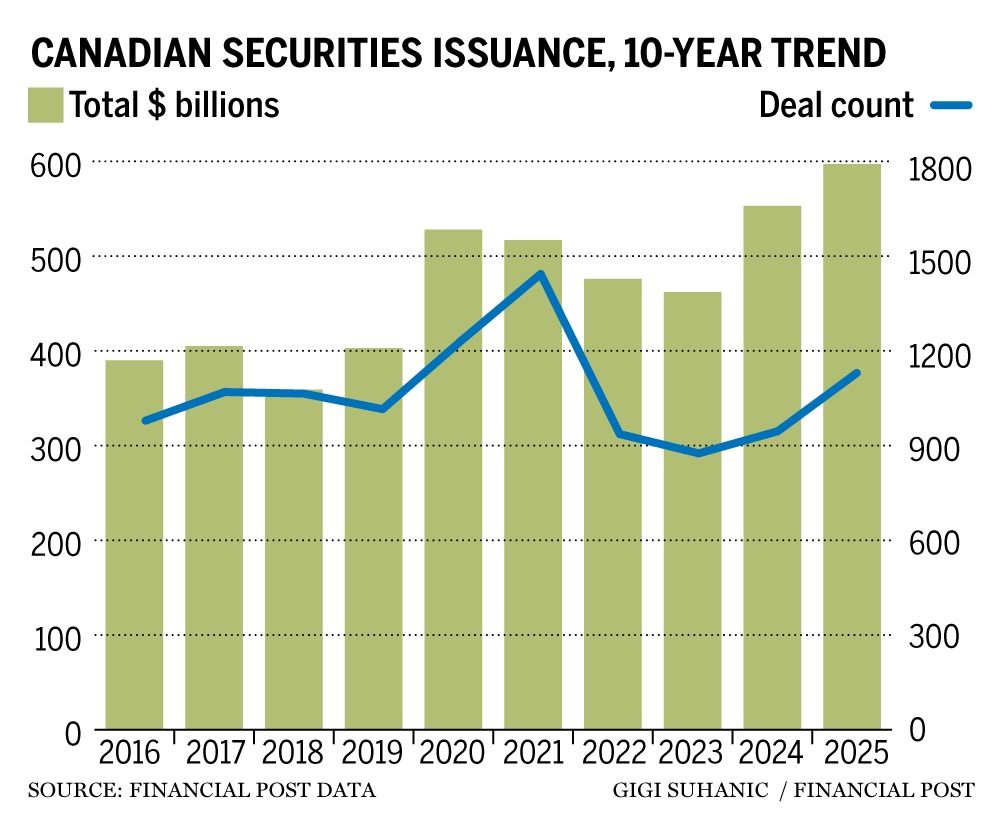

Overall, the capital markets sector raised about $597 billion in 1,133 deals during 2025, the highest dollar amount in the past 15 years and up eight per cent from $553 billion in 2024, according to Financial Post Data.

From the “obvious interest” in companies dealing with

artificial intelligence

and the mining sector to some companies taking advantage of major mergers and acquisitions, “it was a bit of everything” that drove dealmaking last year as opposed to “one reason” that could be applied across the board, Rosalind Hunter, co-chair of Osler, Hoskin and Harcourt LLP’s Capital Markets Group, said.

It was a better-than-expected performance, especially after Trump’s so-called Liberation Day tariffs sent a “chill through markets” in early April, Rob Brown, co-head of Canadian Debt Capital Markets at RBC Capital Markets, said.

“Few people at that time would have predicted that we would rebound as quickly as we did,” he said.

But the dealmakers did and broke a few records in the process. For example, corporate debt issuance reached a 15-year high of $301.5 billion and equity issuance sharply rebounded to $35.2 billion after a slowdown from 2022 to 2024.

A strong capital market is good for the economy because it shows businesses and governments are keen on raising long-term funds to make investments and expand operations and create jobs and boost productivity in the process.

It’s also a good omen for Ottawa, which is looking for private investments to fast-track the building of mostly energy- and mining-related projects in a bid to boost the economy while reducing its reliance on the U.S.

Canada’s biggest banks play a key role in bringing in those investments by helping companies raise money for a fee. In 2025, RBC Capital Markets’ team participated in the most number of deals and helped raise the largest amount of capital — $84.43 billion, or 14.14 per cent of all capital raised in Canada.

“Resilience is an apt word to describe the economy and markets in 2025 given the trade friction and geopolitical developments,” Brown said. “The

Canadian economy

weathered the storm better than expected in the face of tariff headwinds and both equity and credit markets performed extremely well.”

Investors, he said, were motivated to capitalize on “attractive funding costs and accelerate funding plans in light of the ever-present risks related to trade and geopolitics that had the potential to trigger increased volatility and negatively impact market access.”

A major influx of international borrowers also helped raise capital, said Abeed Ramji, head of Debt Capital Markets at TD Securities, which helped raise $63.6 billion, the second most after RBC, giving it a market share of 10.65 per cent.

Capital Markets raised $61.69 billion, the third highest, while CIBC World Markets, National Bank Financial and Scotia Capital Inc. raised $59.86 billion, $54.07 billion and $47.7 billion, respectively, giving them corresponding market shares of 10.03, 9.06 and 7.99 per cent.

Ramji said corporate balance sheets are in “robust shape,” which gives investors “a lot more comfort around being invested in credit.”

He also said there were a record number of “inaugural issuers,” or businesses that issued bonds for the first time, since 2024, with more than 50 new names. In 2023, there were just nine.

“There was an uptick in liability management; the telecom sector was very active in debt-tender offerings, which added a lot of cash back to the market that investors had to redeploy,” he said.

Businesses didn’t rely as much on equity to raise capital between 2022 and 2024, but that trend seemed to change last year as the amount of capital raised through share sales increased 97.3 per cent to $35.2 billion, compared to $17.8 billion in 2024.

It was the highest amount of equity capital raised since 2021, when businesses raised $58.1 billion through 861 deals, according to FP Data, but it subsequently declined to $20.5 billion in 432 deals in 2022, $19.7 billion in 334 deals in 2023 and $18.4 billion in 300 deals in 2024.

Back then, some analysts said the uncertainty in the economy and the poor performances of companies after their initial public offerings during the pandemic impacted the stock price of issuers, which made them less likely to want to issue shares.

In 2025, however, there was a strong rally in the prices of precious and base metals, Miller said. The

S&P/TSX composite index

was up 52 per cent through 2024 and 2025, giving corporate issuers and large shareholders the feeling that share prices were sufficiently high enough to sell, he said.

“Deals in the mining sector made up 45 per cent of the equity issuance volumes in 2025,” Jackie Nixon, head of Canadian Equity Capital Markets at RBC Capital Markets, said. “There was, however, a good breadth of issuance across all sectors.”

The biggest deal on the equity side closed on June 20, when Calgary-based

Keyera Corp.

sold new shares to raise a total of $2.1 billion as it looked to purchase Plains All American Pipeline LP’s Canadian

liquefied natural gas

business plus select U.S. assets for $5.15 billion.

In terms of industries, the materials sector topped the equity deals list, with 293 deals raising $13.05 billion, the sector’s best year in the past decade. The increased focus on the mining sector dovetails with Ottawa’s

Major Project Office

fast-tracking five mining projects among its 13 projects.

Carcetti Capital Corp.’s takeover of

Barrick Mining Corp.

’s Hemlo mine — the latter’s last Canadian mine — for about $1 billion was the biggest deal in the materials sector, followed by B2Gold Corp.’s move to raise US$460 million in January by issuing convertible notes.

The energy sector, which raised $6.54 billion through 30 deals on the equity side, had its best year since 2023. The Keyera deal was the sector’s biggest deal and Energy Fuels Inc.’s raising of US$700 million by selling convertible senior notes was the second biggest.

Overall, Nixon said the global growth narrative, strong equity and commodity performance, together with robust sentiment, drove solid issuance in 2025.

Looking ahead, analysts continue to be cautiously positive as they hope for more stability in the economy.

“While we will be hard-pressed to surpass the record-setting levels of issuance in 2025 … an expected stable policy backdrop from the

Bank of Canada

and Federal Reserve should contribute to robust new issue activity in 2026,” Brown said.

“The health of the economy, effectiveness of pro-growth government policies, central bank positioning and geopolitical developments, including CUSMA negotiations, will likely influence market tone and dealmaking activity in 2026.”

Similarly, Hunter said 2026 has already had a strong start in terms of capital markets, but there needs to be stability for that to continue.

“Even though this past year has demonstrated that markets have high tolerance for geopolitical events, economic stability will still be important to a strong dealmaking environment,” she said.

Hunter, whose firm, Osler, participated in 21 deals and helped raise $26.55 billion in 2025, the third highest among law firms, also said Canadian companies still face challenges in achieving the scale they need to be successful in the public markets.

The “real issue,” she said, is not being able to create an environment that supports Canadian companies.

“Some of that is tax, some of it is our incentive systems, but this is something we need to get right for the future of our country,” she said.

Miller said the geopolitical situation does not appear to be getting any more stable and the main superpowers are in a global race for commodities.

“This should be good for Canada and thus good for continued new issue activity in Canada,” he said.

• Email: nkarim@postmedia.com

Bay Street raises the most money in 15 years despite economic uncertainty

2026-01-15 11:00:53