Hard for Canadian investors to beat last year, when the

S&P/TSX Composite Index

powered through to a 28 per cent gain.

That amounted to the second strongest performance this century and beat the S&P 500 which ended the year up 17 per cent.

Somehow this managed to happen against a backdrop of trade turmoil unleashed by U.S.

President Donald Trump

, fears the economy would sink into recession and political turmoil of our own.

“The key question for investors now is whether stock markets can deliver positive gains for a fourth year,” said investing firm

Edward Jones

in their market outlook out this week.

Strategists are optimistic, with both Edward Jones and

CIBC Capital Markets

predicting upside for equity markets again this year, especially in Canadian stocks.

“Equity valuation in Canada is above its longer-term average but nowhere near bubble territory,” wrote Christopher Harvey, CIBC’s head of equity and portfolio strategy.

“Importantly, tight investment-grade credit spreads are a positive sign for EPS growth. When combined with capex tailwinds from data centre buildout and government infrastructure priorities, we see double-digit EPS growth supporting an above-average market multiple.”

CIBC is predicting the TSX will hit 35,200 in 2026, up 11 per cent from its close on Dec. 31. Its target range for the S&P 500 goes as high as 7,790, up from 6,846 at year-end.

Valuations soared in 2025, but this year “earnings growth will be in the driver’s seat,” said Edward Jones.

They too expect double-digit earnings growth in all 11 sectors of Canadian and U.S. stocks, with a 15 per cent growth rate in Canada.

Improving economic conditions will play a role. Edward Jones expects GDP growth to rebound to about 2 per cent by year end as trade tensions ease, employment rises and interest rates stay supportive.

“After struggling through trade disputes in 2025, the Canadian economy is positioned for recovery as fiscal stimulus measures take effect,” said the report.

Though the

Bank of Canada

is expected to hold its rate at 2.25 per cent, the

Federal Reserve

should continue gradual cuts toward a 3 to 3.5 per cent rate, which will support equity markets, they predict.

Edward Jones’ base case is for markets to be supported by steady economic growth, stable interest rates and rising corporate profits.

But at this stage in the cycle, diversification becomes even more important, said the strategists. It favours U.S. large-cap stocks exposed to AI and mid-cap stocks weighted toward cyclical sectors. It also recommends going global into emerging markets which could benefit from Fed rate cuts and small and mid-cap stocks in developed markets overseas.

In Canadian equities, Edward Jones is overweight in materials, industrials and energy sectors.

CIBC puts financials on top with a 33.2 per cent weight. Its top picks for this sector are Bank of Montreal, Great-West Lifeco Inc, Toronto Dominion Bank and Brookfield Asset Management.

Materials come next with a weight on 17.7 per cent. Gold, silver and copper feature prominently in top picks which include Capstone Copper Corp., IAMGOLD Corp., Kinross Gold Corp., Franco-Nevada Corp., Pan American Silver Corp. and Nutrien Ltd.

Energy’s top picks weighing in at 14.9 per cent are Suncor Energy Inc., Kelt Exploration Ltd., Keyera Corp. and Williams Companies Inc.

Industrials at 10.6 per cent include TFI International Inc., AtkinsRealis Group Inc and CAE Inc.

Shopify Inc, Constellation Software Inc., and Docebo Inc. are the top picks for information technology which gets a weight of 9.8 per cent.

Sign up here to get Posthaste delivered straight to your inbox.

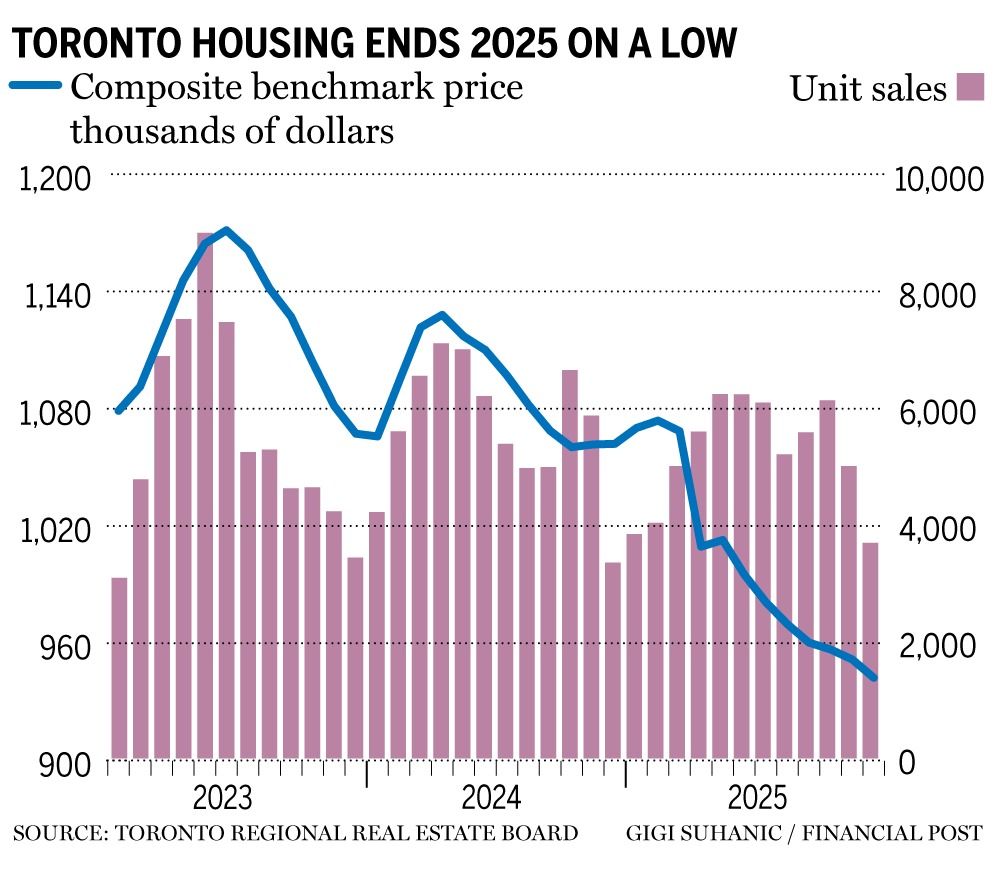

Toronto

home sales

ended the year much like they started — with a whimper.

The number of homes sold in Canada’s largest city fell 0.4 per cent in December from the month before, while the benchmark price slipped 0.7 per cent to $962,000, seasonally adjusted data from the

Toronto Regional Real Estate Board (TRREB)

showed Wednesday.

The declines were part of a trend seen throughout the year. Total sales for 2025 were down more than 11 per cent, and benchmark prices fell more than 6 per cent.

Last February TRREB forecast that sales would rise 12 per cent in 2025. Instead activity was the lowest seen in the Greater Toronto Area since 2000.

Only sellers were out in force. Active listings rose by 10.5 per cent during the year, with new listings hitting their highest level since 1980.

- Today’s Data: Canada international merchandise trade, United States wholesale trade, consumer credit, non-farm productivity and trade balance

- Earnings: Aritzia Inc., Tilray Brands Inc.

- Canada has problems: Here are the tech startups worth watching that are trying to tackle them

- Howard Levitt: 7 survival tips for employers in 2026

- How to make a million a year playing disc golf

The Wealthy Barber author David Chilton is back and this time he has updated his best-selling personal finance guide for today’s young Canadians, more than 30 years after he first published it.

Gen Z and millennial Canadians face different financial issues than previous generations, including out-of-reach home ownership and income uncertainty, making money management seem impossible for some.

In an interview for the Financial Post, Chilton talks about how younger Canadians can get a handle on their finances and set themselves up for successful saving strategies in 2026 and beyond, despite the financial circumstances they may face.

Read more

Interested in energy? The subscriber-only FP West: Energy Insider newsletter brings you exclusive reporting and in-depth analysis on one of the country’s most important sectors.

Sign up here.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: Take heart, Canadian investors, there's life in the bull market yet

2026-01-08 13:03:23