More Canadians jumped into variable

mortgages

in 2025 to take advantage of their lower rates, but doing so in 2026 might prove perilous,

Desjardins Group

says.

“The recent enthusiasm for variable-rate mortgages may wane in 2026, especially if borrowers start anticipating new rate increases,” Hendrix Vachon, principal economist at Desjardins, said in a report.

Canadians have typically preferred five-year fixed mortgages, but he said variable options “have been gaining in popularity from 2024 onward,” estimating they made up 38 per cent of new mortgage financing in October and 32 per of the total outstanding mortgages based on Bank of Canada data.

Rates.ca said in a report on Thursday that interest in variable mortgages has “steadily” increased, based on November financing requests made through the mortgage aggregator.

The interest rate for variable-rate mortgages was 3.97 per cent at the end of October compared with 4.21 per cent for all insured residential mortgages and 4.39 per cent for five-year and above fixed residential mortgages, according to the

Bank of Canada

.

That’s a big turnaround for variable rates, Vachon said.

In the wake of the pandemic, variable mortgage rates fell to a low of 1.5 per cent, only to swoop to a high of 7.48 per cent as the Bank of Canada began hiking

interest rates

to cope with soaring inflation.

Unlike fixed mortgages, variable mortgage rates are just that — variable. Mortgage rates are set based on the prime rate, with most people able to negotiate a discount that remains the same over the term of the mortgage, even though the rate changes with the prime rate.

But Vachon said the tide could be turning on variable rates, so borrowers could find themselves on the wrong side of the ledger.

“For 2026, the outlook is currently less favourable for variable rates,” he said.

The Bank of Canada recently said it was done cutting rates for the foreseeable future, with markets and economists increasing their bets that the central bank’s next move will be an increase.

Desjardins’ latest forecast called for two 25-basis-point rate hikes in 2027 and none in 2026, but markets are betting there will be one rate increase at the end of 2026.

Estimates for the long-term neutral rate, where borrowing levels neither stimulate nor restrict the economy, are set at 2.75 per cent, or 50 basis points higher than the Bank of Canada’s current benchmark lending rate of 2.25 per cent.

If variable-rate mortgages become more expensive, Vachon said more borrowers will likely opt for three-to-five-year mortgages, which overtook the five-year option in fixed popularity.

“Before the pandemic, mortgages with these terms typically accounted for less than 20 per cent of all mortgages before jumping above 50 per cent in 2024,” he said. “Right now, they’re still near 40 per cent.”

For now, it’s no wonder more Canadians have taken the plunge with variable-rate mortgages, given that

housing affordability

is such a hot-button topic.

Displeasure with issues such as the overall cost of living and housing affordability among the sources of most premiers’ plummeting ratings, according to an Angus Reid Institute poll released on Thursday.

“Provincial governments have been viewed as performing poorly on issues such as health care, the

cost of living

and housing affordability, which have been among the top concerns for provincial residents in the past three years,” Angus Reid said in the poll release.

Sign up here to get Posthaste delivered straight to your inbox.

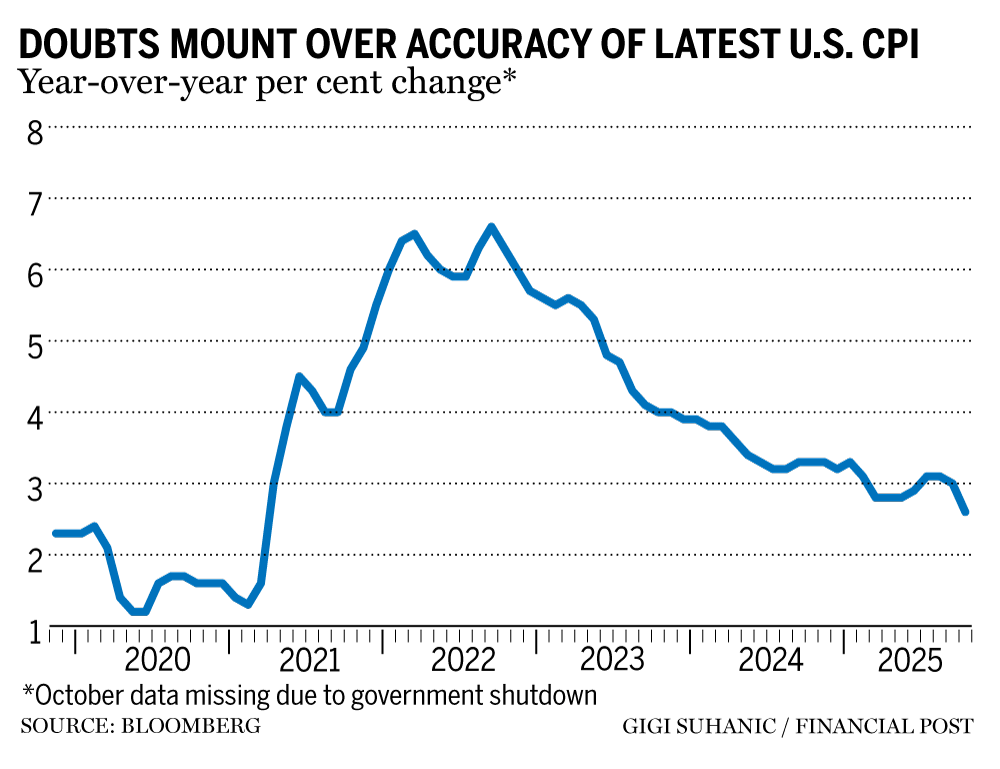

After long-awaited government data showed underlying U.S. inflation cooled to a four-year low in November, economists agreed on at least this much: something was off.

In a report fouled by the record-long government shutdown, inflation in several categories that had long been stubborn seemed to nearly evaporate. Chief among those were shelter costs, which make up about a third of the consumer price index, but other categories like airfares and apparel notably declined. — Bloomberg

Read the full story here.

- Today’s data: Canada retail sales for October; U.S.housing starts and building permits for September, existing home sales for November, new home sales for October, University of Michigan consumer sentiment

- Earnings: Carnival Corp., Winnebego Industries Inc.

- Welcome to the K-shaped economy: Canadians look back on a ‘brutal,’ ‘great’ year in Trump’s trade war

- Atlantic Canada mines policy shift to attract investment

- Oil markets could be in for ‘super glut,’ but Canada’s new pipeline access offers shelter from storm

Interested in energy? The subscriber-only FP West: Energy Insider newsletter brings you exclusive reporting and in-depth analysis on one of the country’s most important sectors.

Sign up here.

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you starting out or making a change and wondering how to build wealth? Are you trying to make ends meet? Drop us a line at

wealth@postmedia.com

with your contact info and the gist of your problem and we’ll find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course).

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus, check out his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Gigi Suhanic, with additional reporting from Financial Post staff, Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: 2026 might prove perilous for Canadians who piled into variable mortgages this year, Desjardins warns

2025-12-19 13:00:52