Job optimism

is starting to rebound and according to a survey out this week a third of Canadian professionals are planning to look for a new position in the new year.

That’s up from 26 per cent in July, when Canada’s economic outlook looked more uncertain, said management consulting firm

Robert Half, which ran the poll.

Job gains have blasted past forecasts in recent months, leading one economist to exclaim, “Canada’s job market is on fire.”

The economy

gained 54,000 jobs

in November, when forecasters had been expecting a loss of jobs, and the unemployment rate dropped from 6.9 per cent to 6.5 per cent, its second decline in a row.

“Many professionals chose not to make a job change throughout 2025, due to economic and global uncertainty, but signs of greater movement are showing as we enter 2026,” said Koula Vasilopoulos, senior managing director of Robert Half Canada.

The top reason employees want to make a move is better benefits and perks, only the second time this has registered as the highest motivator since the firm began tracking worker sentiment.

Competitive pay was the second highest reason and limited career advancement opportunities in their current role was the third.

For younger workers a hybrid position with three to four days in the office was the highest priority.

Forty-three per cent of technology professionals said they would start a job search in the new year, 41 per cent of gen Z workers and 39 per cent of working parents.

However, a separate survey by Robert Half of job seekers suggests that some of the optimism about the labour market may be unfounded.

More than 60 per cent of Canadians currently in-between roles said they expect their job search to take longer than their last one.

Sixty-two per cent said there were too many applicants and too much competition for positions, while 30 per cent found their skills did not meet job requirements.

Lengthy hiring processes and difficulty showcasing qualifications were other challenges listed by respondents.

“Job seekers are facing new challenges in the current landscape, and it may feel harder than ever to stand out in a crowded market,” Vasilopoulos said.

Not everybody believes in the Canadian jobs rebound. Economist

David Rosenberg

in a note last month argued that Canada’s recent numbers were a mirage.

While Statistics Canada’s Labour Force Survey is telegraphing a jobs boom, its Survey of Employment, Payrolls and Hours (SEPH) is telling a different story, said Rosenberg, founder and president of Rosenberg Research & Associates Inc.

In the latter report the number of employees receiving pay and benefits dropped by 58,000 in September. For the first time in five years payroll employment was “completely flat,” he said.

“In a sign that there is more slack in the Canadian jobs market than meets the eye … if we were to superimpose the SEPH employment trend on the LFS (household) survey, the unemployment rate would be 8.2 per cent, not 6.9 per cent — and that would be the highest since May 2021,” said Rosenberg.

Sign up here to get Posthaste delivered straight to your inbox.

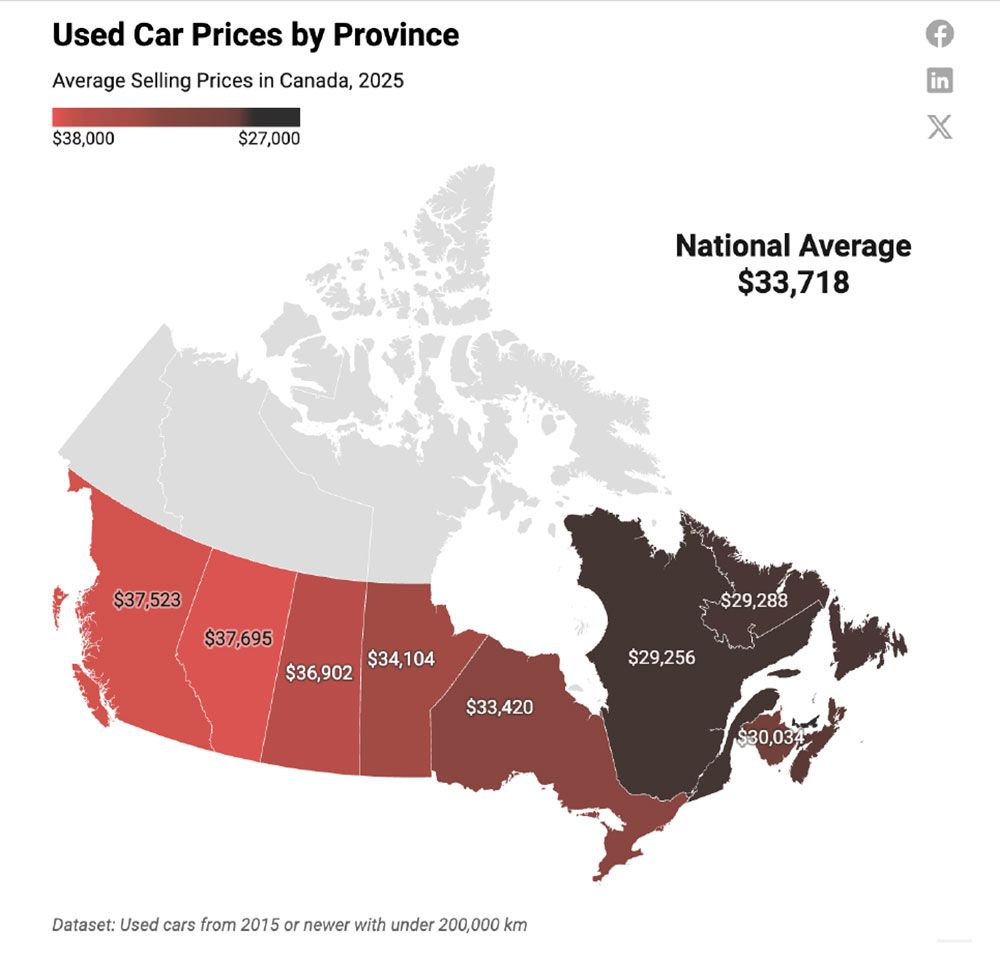

Psst, wanna buy a used car? The cheapest place in Canada to do that is Prince Edward Island, according to auto sales website Clutch’s year-end report. The average selling price of $29,050 is the lowest in Canada as a higher share of older, lower-price cars and compact SUVs keep the market affordable.

Alberta is on the other end of the spectrum. Average vehicles in Canada’s priciest used-car market go for $37,695 and tends to be newer high-spec trucks and larger SUVs.

“A dry climate that’s easier on vehicles and one of the highest household incomes in Canada keeps higher-value inventory in demand — and priced accordingly,” said the Clutch report.

- Today’s Data: Canada International Merchandise Trade, United States trade balance, wholesale trade

- Earnings: Empire Co Ltd., Dollarama Inc., Costco Wholesale Corp., Lululemon Athletica Inc., Broadcom Inc.

- This generation of Canadians is rapidly increasing its wealth and may soon unseat the boomers

- This Canadian mine is as big as a city. It has a basketball court and its chefs serve 4,000 meals daily

- ‘Wild West out there’: Cargo theft reports soar in Canada, but that’s just the tip of the iceberg

Canadian household wealth reached a new collective high of $17.87 trillion in the second quarter of 2025, but there are stark divides between the generations. In the latest quarterly Financial Post Wealth Report, Serah Louis breaks down the generational drama, from surging Gen Xers to the struggles of younger generations.

Find out more

Interested in energy? The subscriber-only FP West: Energy Insider newsletter brings you exclusive reporting and in-depth analysis on one of the country’s most important sectors.

Sign up here.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: Many Canadians want a new job — they may not find one

2025-12-11 13:11:19