People under the age of 35 in Canada have been

piling up wealth

faster than any other age group in recent years, say economists — but those gains could be at risk.

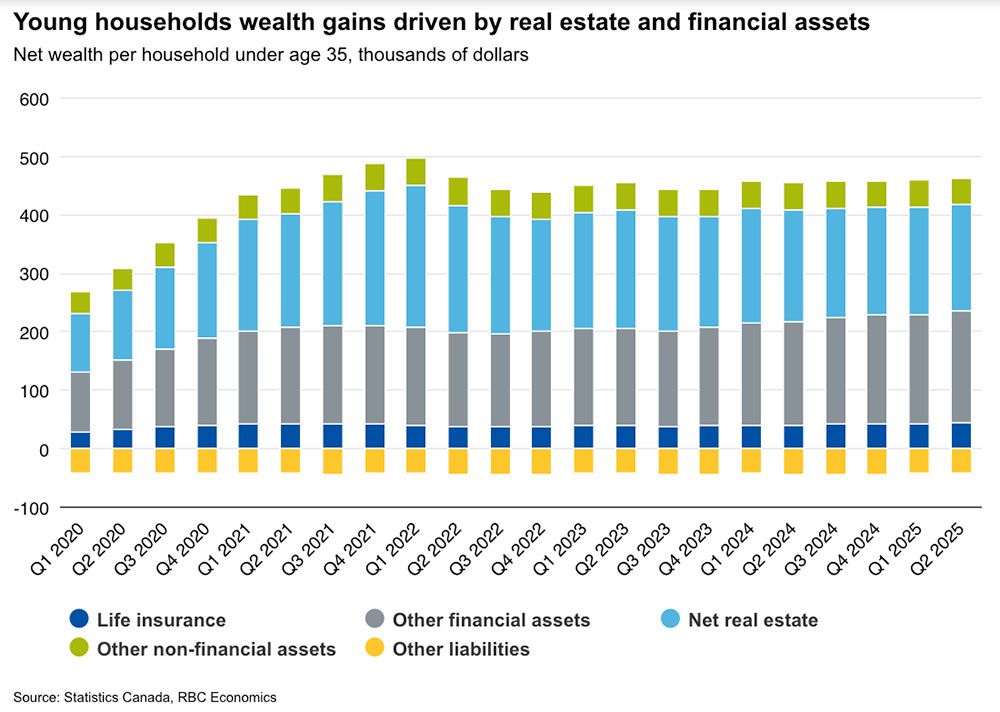

Since the start of the pandemic, younger households have doubled their net wealth, mainly through an increase in financial assets, according to a report by

Royal Bank of Canada.

During the COVID-19 lockdowns, younger Canadians were able to build their financial reserves thanks to government aid such as the

Canada Emergency Response Benefit (CERB)

. A roaring stock market and generational wealth transfers added to the gains, as did the pandemic spike in property values.

Not only did their assets grow, but their liabilities shrank. Their age group is the only one that has seen a decline in

mortgage debt

since 2020.

Those who did buy a home during the pandemic benefitted from rising prices and rock-bottom interest rates; others avoided mortgage debt altogether.

“By postponing or forgoing homebuying due to affordability constraints, some young households avoid new mortgage debt, while those that own real estate retain pandemic-era price gains,” wrote RBC economist Rachel Battaglia, the

author of the report.

But here’s the catch. At the same time that young people were accumulating wealth, their

income growth

was stalling.

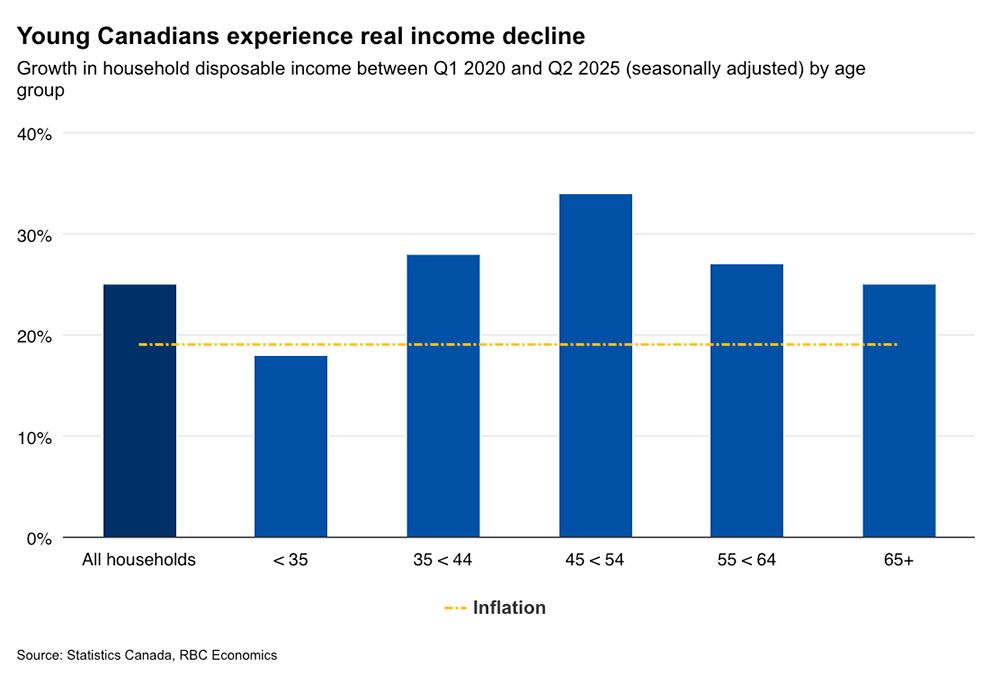

Growth in disposable income for young people has been the lowest of any age group over the past four years, rising just 18 per cent. That’s 16 percentage points below Canadians aged 45 to 55 and eight points below the national average, said Battaglia.

“This makes under-35s the only group where income growth has failed to keep pace with inflation,” she said.

Why is this happening? Young people, who often work in industries vulnerable to economic shocks such as retail, hotels and restaurants, are the first hit when the labour market weakens.

Nearly 40 per cent of the rise in Canada’s

unemployment rate

in recent years has come from young workers, many of them recent graduates who have been unable to find work. The employment rate for under 35s is headed for a three-percentage-point drop from 2020, “indicating a falling share of young people earn employment income in Canada,” said Battaglia.

This puts the pandemic wealth gains of the younger generation at risk.

“The disconnect between income and wealth for young Canadians raises important questions about their financial security as housing and equity markets normalize and the boost from earlier government support continues to dissipate,” said the report.

There are already signs this is happening. In recent quarters, wealth accumulation for households under 35 have slowed more than any other age group.

RBC’s forecast that the labour market will pick up offers hope that further erosion in the fortunes of Canada’s young people can be avoided, but it’s a situation their economists plan to closely monitor in the future.

Sign up here to get Posthaste delivered straight to your inbox.

Is

artificial intelligence

really stealing jobs?

There are signs this is starting to happen in the United States.

Today’s chart shows how office-using employment, which has a higher exposure to AI, peaked in 2023 shortly after ChatGPT was publicly released in late 2022, said TD economist Ksenia Bushmeneva.

It has stalled ever since.

Non-office-using employment, on the other hand, continues to grow.

Jobs in administration and support services, where automation using GenAI can easily replace entry-level roles and tasks, have now fallen below pre-pandemic levels.

- U.S. markets closed for Thanksgiving

- Prime Minister Mark Carney will speak at Calgary Chamber of Commerce on the government’s plan to strengthen Canada’s economic independence, competitiveness and productivity

- Today’s Data: Canada current account balance

- How a ‘unique industrial utopia’ in northern Quebec is defying Trump’s tariffs

- Is your financial adviser really putting you first? Maybe not in Canada

- Howard Levitt: Why Bell Canada’s 700-manager purge is a masterclass in mass layoffs

Renting in Canada may no longer be a short-term, transitory phase before homeownership. The median renter in this country is now over 30 and many have children, according to a recent report, suggesting many Canadians are renting later into their lives. The Financial Post breaks down what the typical Canadian renter looks like and why lifelong renting could become a bigger phenomenon in a costly housing market.

Read more

Interested in energy? The subscriber-only FP West: Energy Insider newsletter brings you exclusive reporting and in-depth analysis on one of the country’s most important sectors.

Sign up here.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: These Canadians have been building wealth faster than any others — but there's a catch

2025-11-27 13:04:52