Housing affordability

has improved in many places across the country, but the small window that opened recently appears to be rapidly closing, says a new survey.

Affordability started to erode in May in eight of the 13 major metropolitan markets because

home prices

rose and borrowing rates stayed the same, according to Ratehub.ca, an online mortgage aggregator, thereby putting upward pressure on the amount of income needed to become a homeowner.

The

Canadian Real Estate Association

(CREA) said

sales in May rose

3.6 per cent month over month as homebuyers emerged from their protective shell. It was the first month-over-month increase in sales since November. Prices also rose month over month 1.9 per cent, CREA said.

Prior to that, elevated

interest rates

made homebuying similar to the pandemic years. More recently, rising global economic uncertainty unleashed by United States President

Donald Trump

forced many Canadian

homebuyers

to park their real estate aspirations, leading to falling prices and sales across the country.

The top three price increases were recorded in St. John’s, N.L., where prices jumped $8,900 in May from April to an average price of $378,300; Halifax, where prices rose $7,600 to $570,600; and Regina, where they were up $5,400 to $340,800.

In St. John’s, the income required to qualify for a mortgage climbed $1,690 to $86,450 per year. These calculations are based on a mortgage with a 10 per cent down payment, 25-year amortization, mortgage rate of 4.38 per cent and stress test rate of 6.38 per cent.

In

Montreal

and

Toronto

, prices rose $5,200 and $3,400, respectively, to $580,100 and a bit more than $1 million. The required income to qualify for a mortgage increased by $980 and $650, respectively, to $124,620 and $206,500.

Winnipeg, Edmonton and Fredericton had the smallest price gains.

However, five other cities recorded falling prices and improved affordability.

The largest price drop was recorded in Hamilton, about an hour east of Toronto, where prices fell $18,300 to an average price of $783,100. It had the biggest improvement in affordability for the second consecutive month.

In

Vancouver

, one of Canada’s most expensive housing markets, prices fell $7,500 to almost $1.2 million.

Prices in Victoria and Ottawa fell $4,600 and $1,400, respectively, to $892,700 and $629,800.

In Calgary, prices were flat at $583,000.

In Hamilton, Ratehub said monthly mortgage payments in May dropped by $93 and that the amount of income required to qualify for a mortgage was $163,020, down $3,480.

A majority of homebuyers have indicated they are willing to adjust where they would live to gain some affordability if prices continue to rise in their desired location.

For example, 52 per cent of potential homebuyers surveyed by Zoocasa said they were open to living in a secondary city such as London, Ont., or Fredericton, but would have to do more research to make sure life there is more affordable.

The survey also said people hold an increasingly dim view of housing affordability in Canada, with 67 per cent indicating they believe housing in this country is somewhat to much less affordable compared with other countries.

The survey of 1,000 Zoocasa blog readers and newsletter subscribers was conducted between Jan. 30 and April 28. It has a margin of error of two per cent.

Sign up here to get Posthaste delivered straight to your inbox.

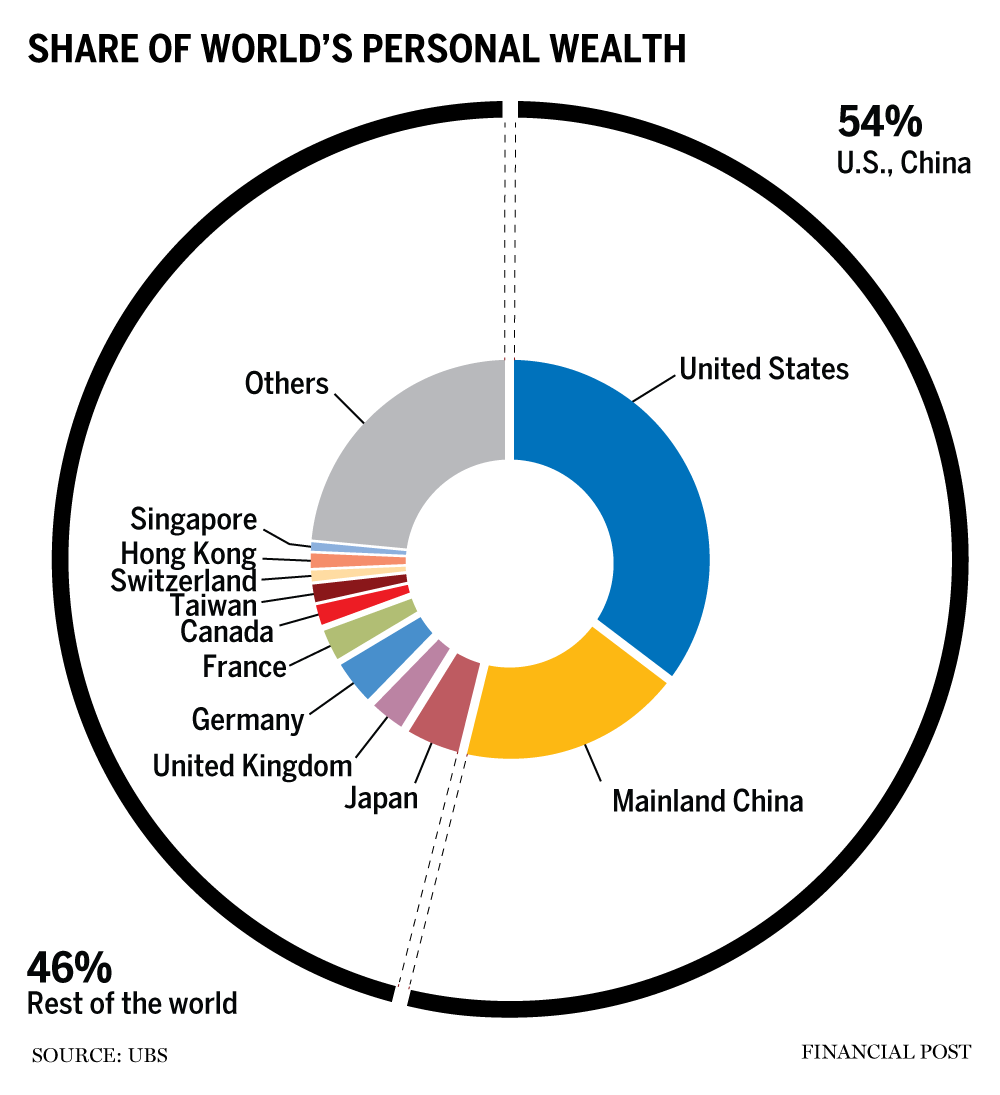

The world is getting wealthier, with the ranks of those with US$1 million or more continuing to expand, according to a recent report from Swiss financial services firm UBS Group AG.

In Canada, median wealth per adult ballooned by nearly 10 per cent in local currency in 2024, the report stated.

Real estate appreciation and a robust stock market last year are among the factors contributing to this, said Josh Sheluk, portfolio manager at Verecan Capital Management.

“I think as long as you’re having growth of economies globally, you’re going to see spillover effects to Canada and, quite frankly, to most regions of the world,” Sheluk said. “I think we’re well positioned here in Canada to benefit.” — Serah Louis, Financial Post

Read more here.

- Toronto Tech Week continues

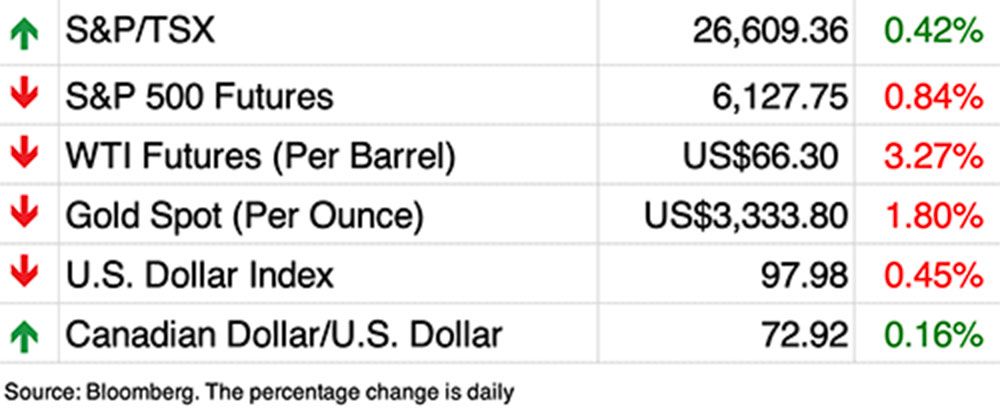

- Today’s Data: Statistics Canada reports May inflation. U.S. Philadelphia Fed non-manufacturing activity, current account balance

- Earnings: BlackBerry Ltd., Salesforce Inc., The Campbell’s Company, Dollar Tree Inc., Foot Locker Inc., American Eagle Outfitters Inc., Dollar General Corp., Tilly’s Inc., Victoria’s Secret & Co.

- David Rosenberg: How did the Canadian market hit a new record? Gold exposure has helped

- Soaring costs are forcing some Canadians to limit vet visits or even give up their pets

- M&A in Canadian oil and gas accelerating: ‘We see a lot of consolidation’ says Keyera CEO

The average Canadian family will save $280 on their taxes next year from the Liberal government’s planned

income tax

cut, the

parliamentary budget officer

said in an analysis.

Find out more here.

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you starting out or making a change and wondering how to build wealth? Are you trying to make ends meet? Drop us a line at

wealth@postmedia.com

with your contact info and the gist of your problem and we’ll find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course).

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Gigi Suhanic with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: Here’s 5 Canadian cities where you can make less and still buy a home

2025-06-24 12:00:01