More

Canadian snowbirds

are putting their properties in Florida on the market, according to media reports, but unloading them might not be that easy —

especially condos.

Real estate in the Sunshine State boomed during the pandemic, but now the tables have turned and the condo market is in a serious slump, said Admir Kolaj, a Toronto Dominion economist, in a recent report.

Condos play a big role in

Florida real estate

. There are about 1.5 million of them, accounting for 15 per cent of the state’s housing stock, double the national share.

Over the past three months, sales have dropped 13 per cent and are down more than 25 per cent from pre-pandemic levels. Prices have fallen about 8 per cent from their peak, said Kolaj.

Inventories are climbing, with close to 80,000 condos and townhomes for sale, about 20,000 or 35 per cent more than a year ago.

Headwinds buffeting the market include higher

interest rates

(mortgage rates in the U.S. are still close to 7 per cent), a steep drop-off in domestic migration and economic uncertainty brought on by

Donald Trump’s tariff war.

But Florida condos face their own special set of problems. For one, the Sunshine State is the most expensive in America for

homeowners insurance

, with condo-specific premiums estimated at double the national average, said Kolaj.

Homeowner association fees are also climbing under new stricter regulation on condo inspections and repairs. Buildings older than 30 years — more than half the condos in Florida — must undergo milestone inspections and condo associations have to foot the bill for repairs. Kolaj said in some reported cases where there was the need for major repairs special assessment fees ran into the thousands.

“Given all the headwinds that the condo sector faces, it is no wonder that many owners are choosing to list their units for sale, growing the glut in an already-flooded market,” he said.

Canadians are among them.

Florida has the largest share of foreign home buyers in America, accounting for 20 per cent of the national total. Twenty-seven per cent of those buyers are Canadian, the highest percentage save for Latin Americans.

According to media reports, more of those Canadians are putting their properties on the market, spurred by a weaker dollar, stricter travel requirements and Trump’s repeated comments about Canada as the 51st state.

Realtors in Florida told CNN

earlier this year they have seen a “sharp uptick” in Canadians looking to sell their homes.

“Some of the clients I have been dealing with want to sell at any cost, even at a loss,” said Share Ross, a realtor based in southeast Florida.

Gulf Coast News reported in April that Canadians were making a “mass exodus” from Southwest Florida, after the U.S. required background checks and fingerprints if they planned to stay more than 30 days in the state.

Reduced foreign interest is just one more thing on a long list of challenges facing Florida’s condo market, said Kolaj. And owners may have to wait a while for a rebound.

There are indications that the state will soften its law on older condos and if other conditions fall into place the condo market could find firmer footing by late 2026, he said.

Sign up here to get Posthaste delivered straight to your inbox.

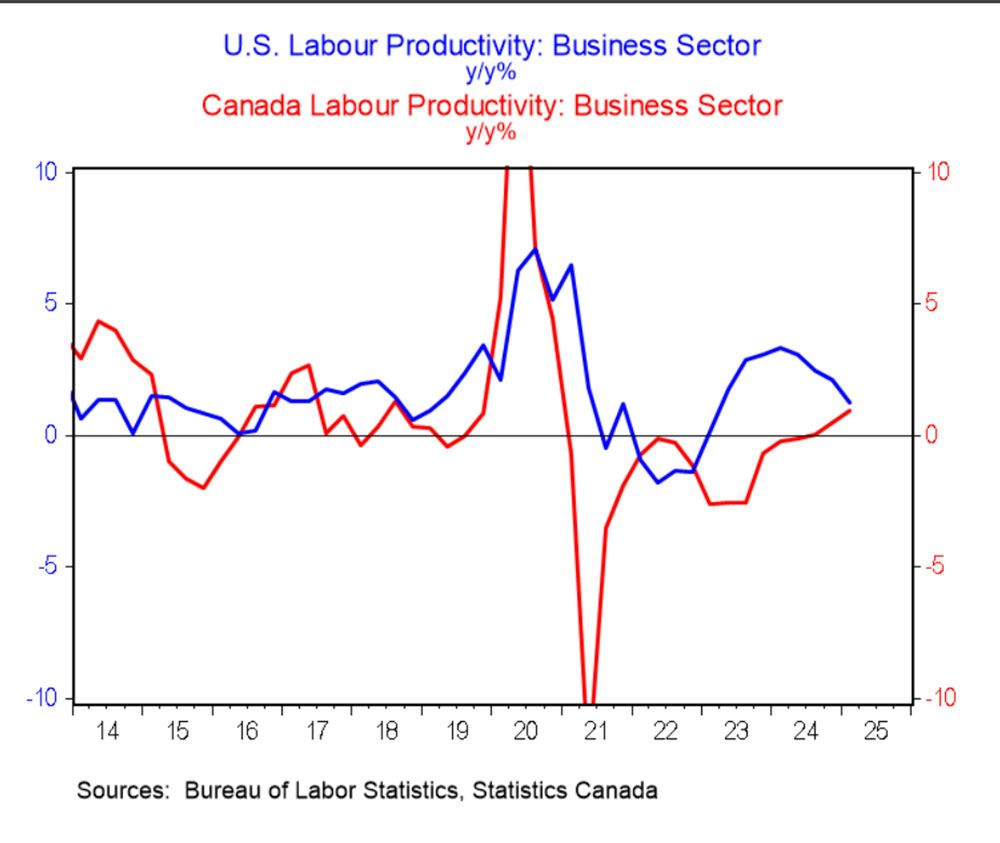

Canadian labour productivity is finally making gains. As today’s chart from BMO Capital Markets shows productivity growth is on the rise and catching up to the growth rate of the United States, though that has been declining.

Statistics Canada said last week

that productivity grew 0.2 per cent in the first quarter of 2025. That’s down from 1.2 per cent growth in fourth quarter of 2024, but it is the first time there have been consecutive quarterly increases since the start of the COVID-19 pandemic.

“The bad news is that productivity could take a hit in the coming quarters as economic growth is expected to slow meaningfully due to trade uncertainty,” said BMO senior economist Shelly Kaushik.

- Former prime ministers Jean Chretien, Joe Clark and other politicians and experts attend a summit in Calgary to discuss issues including peace and security, trade, energy security and critical minerals, artificial intelligence and quantum computing.

- Today’s Data: United States Producer price index

- Earnings: Transat AT Inc., Adobe Inc.

- National Bank’s $5 billion megadeal was decades in the making for Dominic Paradis

- Can Canada repair ties with China? How the two countries could end the tariffs war and expand trade

- Don’t assume further rate cuts from the Bank of Canada, Poloz warns

With the cost of homes on the rise, the typical first-time homebuyer in Canada looks different than in the past. The

Financial Post takes a look

at who is buying and what it takes for them to own their first home.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: Canadian snowbirds now have more reasons than Trump to dump that Florida condo

2025-06-12 12:05:05