A funny thing has been happening to the

Canadian dollar

lately.

Despite evidence that the economy is weakening, the currency has been going up, not down, rising 3 per cent against the U.S. dollar since President

Donald Trump

‘s Liberation Day.

That’s not usually how it works, but some strategists think this is more than just a temporary overshoot.

Desjardins Group expects

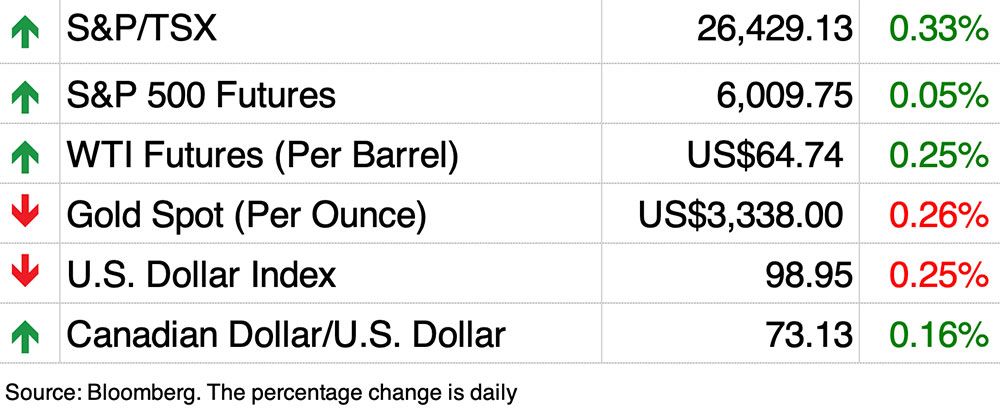

the divergence will continue to widen in coming months, with the loonie rising to 74 cents U.S. by the end of this year and to almost 77 cents U.S. by the end of the next. It was trading up at 73.08 this morning.

The forecast is based on the

U.S. dollar losing strength

rather than the Canadian dollar gaining it, said Mirza Shaheryar Baig, a foreign exchange strategist with Desjardins. The loonie’s performance against other major currencies has not been stellar.

“Net-net, a strong loonie is the result of a shift in global capital flows leading to a broadly weaker U.S. dollar,” he said.

Since Liberation Day the U.S. dollar has become positively correlated with stocks.

“In other words, it has lost its safe haven appeal. This matters because many Canadian institutional investors who did not hedge the currency risk on their U.S. investments are now being forced to raise their hedge ratios,” said Shaheryar Baig.

The outlook for the U.S. economy is also weakening. Coming out of the pandemic, it grew faster than other economies, but that has changed. Expectations for U.S. growth have dropped and are now in line with other advanced economies, he said.

The Organisation for Economic Co-operation and Development

warned last week

that Trump’s tariff war will sap global growth in 2025 and it gave the United States the biggest downgrade among G7 nations. The

OECD sees its growth

slowing sharply from 2.8 per cent in 2024 to 1.6 per cent this year, and 1.5 per cent next.

Trump’s tactics to raise the income share of American workers is also unnerving investors, said Shaheryar Baig. Telling

Walmart Inc.

“to eat the tariffs” and threatening

Apple Inc.

with duties on products made out of the country does not help boost the profits investors are looking for.

“To many investors, American capitalism now resembles Chinese ‘common prosperity,’” he said.

Desjardins admits its forecast has risks. America dodged a widely expected recession in 2023 and its economy could surprise again. Carry trade in the U.S. dollar, which has the highest deposit yields in the G7, could also revive, he said.

The downside of a strong Canadian dollar against the greenback is that it makes exports more expensive, a drag on Canada’s already fragile economy.

Desjardins believes this will force the

Bank of Canada

to cut its interest rate another 75 basis points to 2 per cent this year.

Sign up here to get Posthaste delivered straight to your inbox.

Canada’s manufacturing sector has been slammed by tariffs, but now new data shows that services, which makes up a much bigger share of the economy, are suffering too.

S&P Global’s Services PMI for May shows this sector is not only in contraction, but is also the weakest of all 14 countries covered, said National Bank of Canada economists.

Earlier last week S&P Global’s manufacturing PMI put Canada as the lowest among 30 countries.

“That’s dead last in manufacturing and dead last in services, leaving Canada as clear outlier in this sample of key peers,” said National.

- Prime Minister Mark Carney will be in Toronto today to make an announcement related to “defence and security priorities.”

- Today’s Data: United States wholesale trade

- What is the bond market and why is everybody so worried about it?

- The robots are coming! 10 predictions on what AI means for your mortgage and home

- Canada’s unemployment rate hits 7%, highest since 2016 outside the pandemic

The bond market has been making headlines lately as Donald Trump’s “big beautiful’ bill raises concern about the state of America’s finances. But just what is the bond market, how does it work and why is it such a problem when investors get jittery about it?

The Financial Post explains.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: Why the Canadian dollar is going up when the economy is going down

2025-06-09 12:00:42