The global economy is headed for a downturn, and North America will be hardest hit,

the world’s economic watchdog warned

today.

The

Organisation for Economic Co-operation and Development

said Tuesday that barriers to trade, tighter financial conditions, weaker business and consumer confidence and heightened policy uncertainty will sap global growth in 2025.

Slashing its forecast for the second time this year, the organization now sees global gross domestic product slowing from 3.3 per cent in 2024 to 2.9 per cent this year and in 2026, assuming that U.S. President

Donald Trump’s tariff rates

are sustained despite legal challenges.

“The slowdown is concentrated in the United States, Canada and Mexico, with China and other economies expected to see smaller downward adjustments,” said the OECD.

Canada’s GDP

is forecast to grow 1 per cent in 2025 and 1.1 per cent in 2026, down from 1.5 per cent in 2024. However, it was one of the few countries in the G20 to get an upgrade from the March forecast.

Still the outlook can hardly be called cheery.

“Since February 2025, trade tensions and increased tariffs on imports to the United States heavily weigh on Canada’s external perspectives, given the interlinkages of the two economies,” it said.

After starting the year on “robust” footing, Canada’s outlook has deteriorated. The OECD expects growth to drop in the second quarter as exports to the United States fall sharply and household consumption and business investment are hit by trade disruptions and uncertainty. The

housing market

is expected to remain broadly flat in the first half of the year.

Tariffs imposed by Trump’s administration on other countries in the world will further dampen demand for exports, it said.

The OECD expects the

Bank of Canada

to cut another 50 basis points to bring its interest rate to 2.25 per cent this year. “The central bank will need to carefully balance the opposing impacts on

inflation from tariffs: upward pressure from higher import prices and downward pressure from lower demand,” it said. The impact of lower interest rates won’t show up in the economy until 2026.

The United States took the biggest downgrade among G7 nations. The OECD sees its growth slowing sharply from 2.8 per cent in 2024 to 1.6 per cent this year, and 1.5 per cent next.

Inflation due to higher import prices is expected to near 4 per cent by the end of the year, keeping Federal Reserve rate cuts on hold until 2026, it said.

“Weakened economic prospects will be felt around the world, with almost no exception. Lower growth and less trade will hit incomes and slow job growth,” said OECD chief economist Álvaro Pereira.

Agreements to ease trade barriers and tensions are instrumental to turning growth around, he said. “This is by far the most important policy priority.”

Sign up here to get Posthaste delivered straight to your inbox.

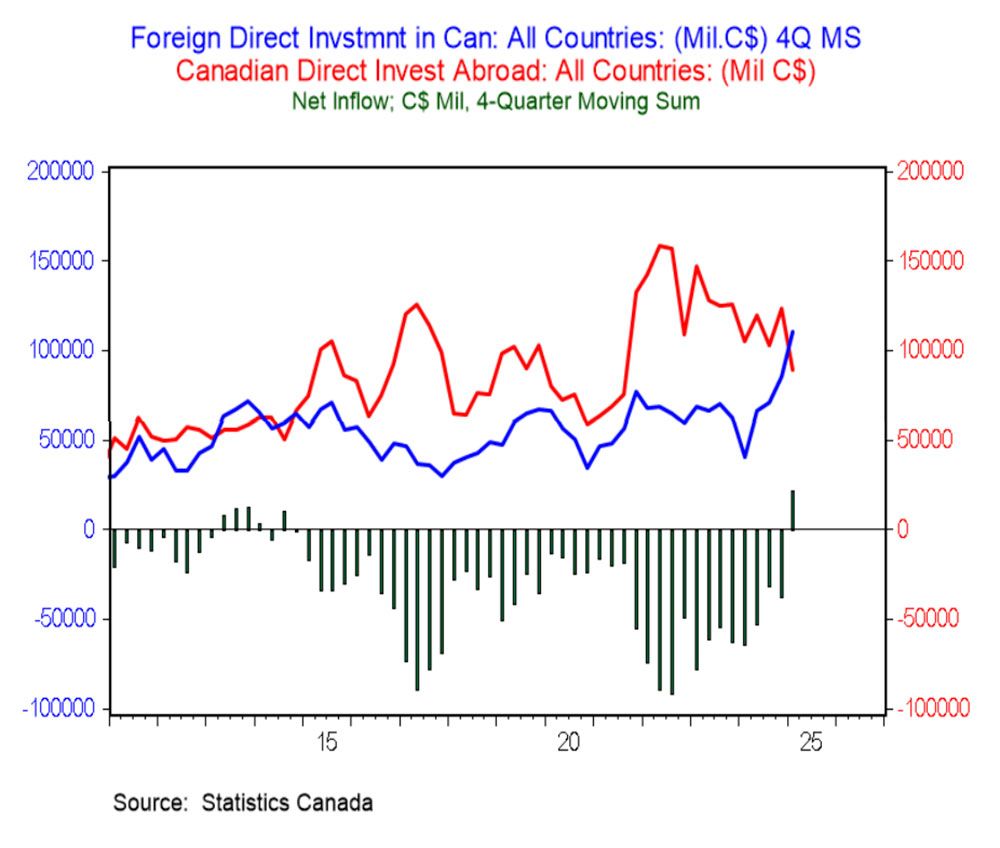

Foreign investment is flowing into Canada at the second fastest pace in 20 years. In the first quarter, inflows totalled $28 billion, while outflows fell to $7 billion, said Douglas Porter, chief economist of BMO Capital Markets.

Looking at the past four quarters, investment coming into Canada surged to $111 billion, a high not seen since the mining mega mergers in 2007 and 2008, said Porter, and investment abroad slowed to $90 billion.

The net inflow over the past year of $21 billion is the first foreign direct investment surplus in 11 years, he said.

- Today’s Data: United States factory and durable goods orders

- Earnings: Dollar General Corp., Hewlett Packard Enterprise Co.

- Canada’s steel industry says Trump’s next tariff hike threatens ‘mass disruption’ to supply chain

- Canadian banks are resilient and delivering decent results, but real estate risks loom

- Trump tariffs take Detroit and Windsor from ‘best friends’ to verge of break-up

Despite a challenging economic backdrop, Canada’s major banks continue to deliver decent results. Yet beneath the surface of earnings beats and dividend hikes, a growing undercurrent of risk is emerging.

Find out more

from investing pro Martin Pelletier.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: Canada to take brunt of one of the worst slowdowns since the pandemic, warns OECD

2025-06-03 12:04:26