The Bank of Canada paused interest rate cuts in April to get a better of idea of where Donald Trump’s tariffs and the economy were headed.

A month and a bit on and it’s questionable whether that outlook is any clearer.

Last week the U.S. Court of International Trade ruled against the tariffs Trump invoked under International Economic Emergency Powers Act, though that decision has been put on hold by an appeals court.

Then on Friday Trump said he would double tariffs on steel and aluminum, of which Canada is a major supplier, to 50 per cent to help protect American workers.

Plenty is unclear then on the trade front, but signals from the economy have been almost as murky.

One of the key arguments for a pause when the Bank of Canada decides on rates this Wednesday is that core inflation data last month came in hotter than expected.

However, that acceleration was more benign than it looked, said Jimmy Jean, chief economist for Desjardins Group, coming from a small set of components, such as rents and airfare, that are typically volatile.

Goods affected by retaliatory tariffs from Canada also helped hike prices, but there is reason for “cautious optimism” on this front, he said. So far Ottawa has put tariffs on about $60 billion worth of U.S. goods, though a portion of these have been put on pause.

“While future trade policy decisions affecting Canada remain hard to predict, the tone between Ottawa and Washington has grown more conciliatory in recent weeks,” said Jean. “The legal obstacles that Trump’s trade policy encountered this week could perhaps also help pave the way for a deal.”

It’s therefore looking less likely that Canada will go ahead with tariffs on the full $185 billion list of goods, he said. Moreover, a stronger Canadian dollar, lower oil prices and the scrapping of the carbon tax will help ease price pressures.

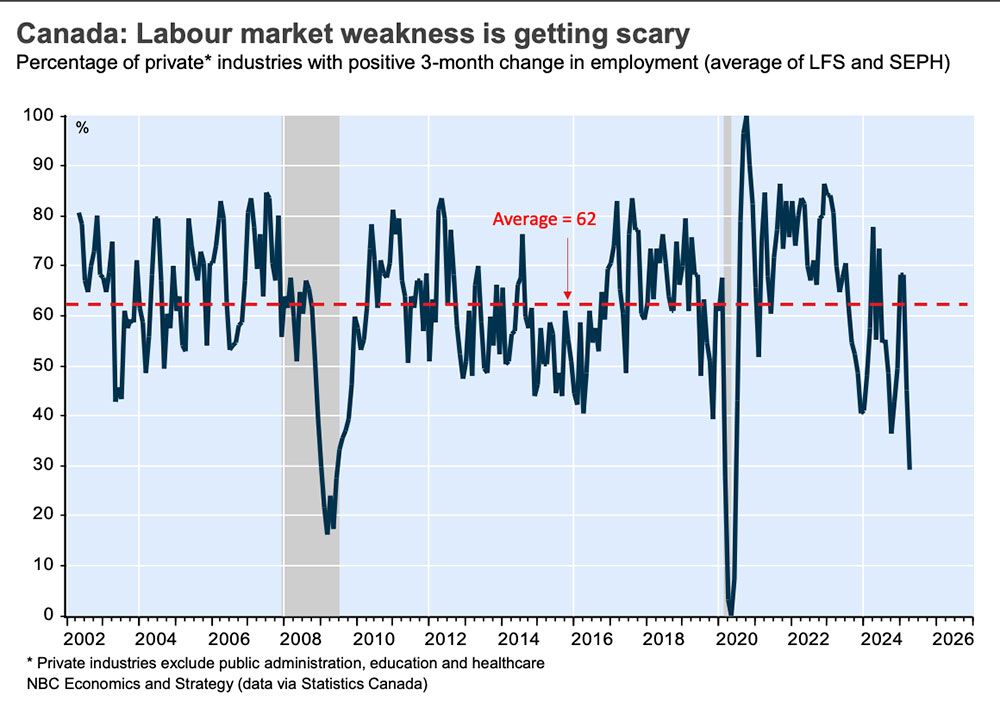

The labour market is probably a better guide to where the economy is going and here things are not looking so good, said Stephen Brown, deputy chief North America economist for Capital Economics.

April narrowly avoided another decline in employment, only because of jobs related to the federal election. The private sector lost 78,000 positions in three months and is expected to lose more.

David Rosenberg, president of Rosenberg Research & Associates Inc, said in a recent column that with the unemployed swelling 14 per cent over the past year weak, labour data show the need for more rate relief in Canada.

“There can really be little doubt that the Canadian economy has entered a recession, and the Bank of Canada would be well advised to move out of the dugout and onto the baseball field,” he said.

Yet the markets are only putting a 20 per cent chance on another cut this Wednesday.

Economists with Royal Bank of Canada, who predict a hold, said the data hasn’t been all bad since the central bank’s last decision.

RBC’s own cardholder tracking shows consumer spending held up better than expected in March and April and job postings on Indeed.com signal that hiring demand may be stabilizing.

The Bank of Canada has cut more than other central bank in a developed nation and if the economy weakens it still has room to reduce the rate further, said RBC economists Nathan Janzen and Abbey Xu. But it also must consider the impact of government support, which is a more effective tool to provide targeted aid for sectors hit by the tariff war.

Sign up here to get Posthaste delivered straight to your inbox.

Job loss in the private sector is now at levels that in the past have only been seen in recessions, says

National Bank of Canada.

Data from the Survey of Employment, Payrolls and Hours showed that employment fell for the third month in a row in March, racking up a cumulative net loss of 78,000 jobs.

Both that indicator and Statistic Canada’s Labour Force Survey show that 71 per cent of private sectors have contracted over the past three months, said National economists.

- Local real estate boards will release the latest data on home sales and prices in their regions for May this week, starting with Calgary today, Vancouver on Tuesday and Toronto on Wednesday.

- Today’s Data: United States ISM manufacturing, construction spending

- Earnings: The Campbell’s Company

- Forget the trade war, the fish are biting in Canada

- Should Moira manage her $400,000 RRSP investments on her own?

- Think the issue of workplace vaccine mandates is long-settled? Not quite, say courts

Moira, now 55, plans to retire at 60. She has $500,000 in RRSPs, two-thirds of it in a fully managed account with a major brokerage. For an average of six per cent returns in the past seven years, she is paying 1.94 per cent, which is more than $600 a month.

She manages $100,000 of that on her own and wonders if she should get a self-managed account and put it all in a balanced fund with low fees, or exchange-traded funds (ETFs).

Find out what FP Answers recommends.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: Markets expect a Bank of Canada pause, but these economists have other ideas

2025-06-02 12:00:37