The growing economic uncertainty is forcing Canadians to miss their

credit card payments

at rates not seen since the financial crisis.

The average Canadian owes $21,859 in non-mortgage debt in the face of higher prices and a strong auto loan market, according to a new report by Equifax Inc.

Demand for non-mortgage debt has slowed down in recent quarters, but balances have remained flat, which Rebecca Oakes, vice-president of advanced analytics at Equifax Canada, believes is a sign that paying down existing debt has been a challenge.

“Our data shows card payment levels, especially for younger consumers, are starting to fall, indicating this spending slowdown is likely driven more by consumers trying to be prudent rather than switching from credit to debit for financing,” she said in a news release.

Oakes called the reduced credit card usage in the first quarter a “positive shift,” but said there could be more challenges ahead.

“Headwinds will likely persist, such as rising unemployment and rising food prices, in already strained regions,” she said.

The average pay rate dropped 32 basis points to 52.9 per cent in the quarter, with 1.4 million Canadians missing a credit card payment.

“Although mortgage holders experienced some stabilization thanks to steady

interest rates

, financial strain remained acute for non-mortgage consumers,” the report said. “Consumer-level delinquency rates among non-mortgage holders rose 8.9 per cent year over year, compared to 6.5 per cent for mortgage holders.”

Another

report by TransUnion of Canada Inc.

said Canadians who are considered a high risk of defaulting on credit card payments are more vulnerable than ever. Canadians in this demographic who opened a credit card during the past two years were twice as likely to become delinquent in the first 12 months of opening the card.

TransUnion said Albertans are most likely to default on credit repayments, with a non-mortgage delinquency rate of 2.35 per cent. It said the volatility in Alberta’s oil and gas sector plays a role in the high delinquency rate.

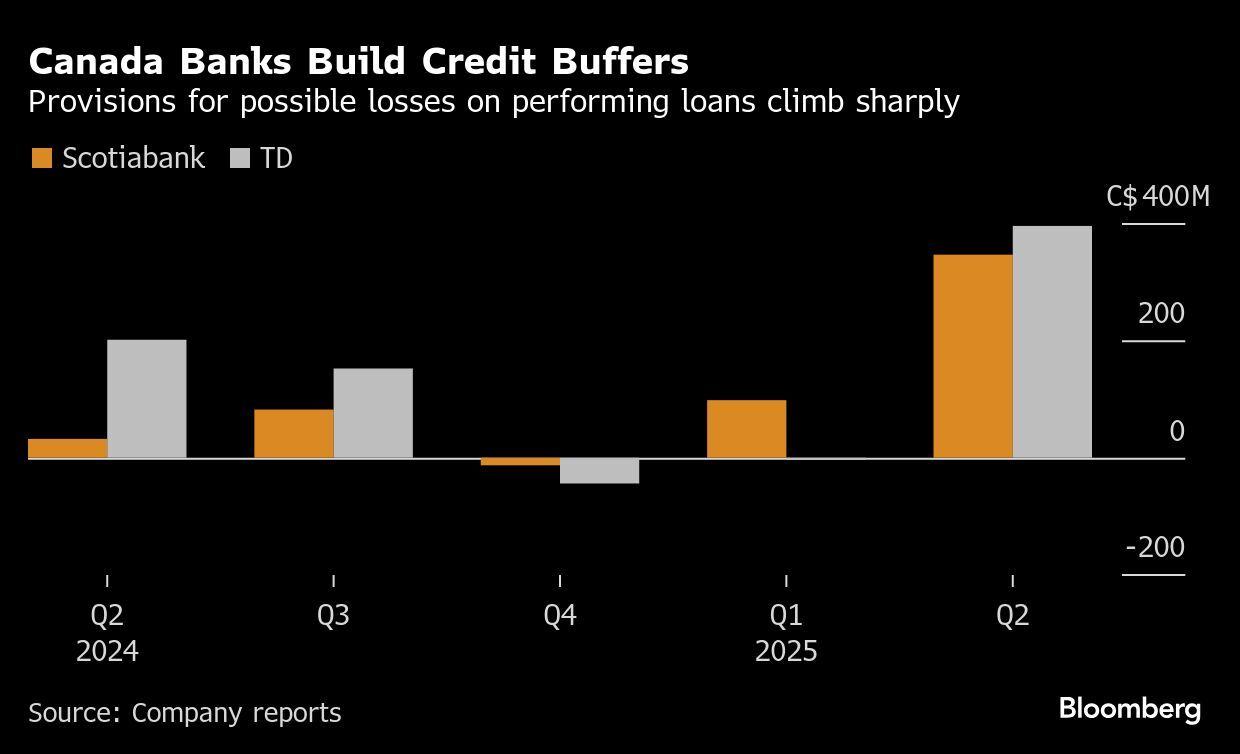

Canada’s big banks are preparing for an uptick of bankruptcies. On Tuesday,

Bank of Nova Scotia

said it had increased the money it sets aside for bad loans — known as provisions for credit losses (PCLs) — to $1.39 billion. Toronto-Dominion Bank last week said it had increased its PCLs to $1.3 billion.

Sign up here to get Posthaste delivered straight to your inbox.

As Canada’s big banks report quarterly earnings this week, early signs show they are not optimistic about the state of the economy.

Both Scotiabank and Toronto-Dominion Bank have upped their provisions for credit losses (PCLs), a typical sign that banks are bracing for delinquent payments or bankruptcies.

Scotiabank

increased its PCLs to $1.39 billion, while TD hiked PCLs to $1.3 billion.

The Bank of Montreal is scheduled to release its earnings on Wednesday.

Read more here.

- OPEC Joint Ministerial Monitoring Committee meeting

- U.S. Federal Reserve’s FOMC minutes from May 7 interest rate decision

- Earnings: NVIDIA Corp., Salesforce Inc., Bank Of Montreal, HP Inc., U-Haul Holding Co., Abercrombie & Fitch Co., Universal Corp.

- Scotiabank posts lower profit amid uncertainty related to U.S. tariffs

- Pivotal pipeline decision looms to determine fate of Canada’s next big LNG terminal

- The tax hit to Canadians from Trump’s ‘big beautiful’ bill could be tremendous

- OECD predicts Canadian economy will avoid recession, but will see flat growth in 2025

For those looking to gift money to young ones for education with a fully topped up Registered Education Savings Plan (RESP), a contribution to a registered retirement savings plan (RRSP) could be an option, though taxes must be paid on their withdrawal. Testamentary trusts are also an option, though they require accounting and legal fees.

Read more here.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Ben Cousins with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: Canadians are missing credit payments at rates not seen since the financial crisis

2025-05-28 12:00:17