The days of

burning your mortgage

as a rite of passage into your golden years appear to be slipping into the past along with rotary phones and station wagons.

A new

survey by real estate company Royal LePage

suggests that

millennials and gen Z

are not the only generations struggling with

housing affordability

in Canada — seniors are carrying the burden well into retirement.

Almost a third of Canadians who are planning to retire in the next two years will continue to make mortgage payments on their primary residence into retirement, the survey said.

That’s twice as many seniors carrying mortgage debt as a decade ago, and in 1999 the share was just eight per cent.

Home prices in Canada soared to $827,100 in 2023 from $120,200 in 1990, according to the

Canadian Real Estate Association

, and these gains have been a “double-edged sword” for older Canadians, Royal LePage chief executive Phil Soper said.

“On one hand, it has delivered unprecedented financial gains. On the other, this generation is far more likely to have carried mortgage balances that would have been unimaginable to their parents or grandparents,” he said.

It’s a trend that will likely continue as first-time homebuyers increasingly enter the housing market later in life.

A Royal LePage study in 2023 said 43 per cent of first-time homebuyers were aged 35 and older, up from 33 per cent just two years earlier.

In the pricey Ontario real estate market, the median age of a first-time homebuyer hit 40 in 2024, up from 36 a decade earlier, which

Teranet said

is “a testament to the likely effects of the affordability challenges in the Ontario housing market.”

Yet the Royal LePage survey also showed that a surprising number of older Canadians are not willing to downsize in retirement — nearly half, 47 per cent.

Seniors in Manitoba and Saskatchewan, according to Royal LePage brokers, are more inclined to downsize, while more retirees in Quebec and Ontario opt to stay in their own homes.

“The benefits of entering retirement as a homeowner with a paid-off mortgage are clear: more disposable income, insulation from interest rate changes, and even the emotional security that comes from knowing you’ll always have a place to live,” Soper said.

“In the era of rotary phones and station wagons, burning your mortgage was the economic finish line. Today’s retiree reality is much more nuanced.”

Sign up here to get Posthaste delivered straight to your inbox.

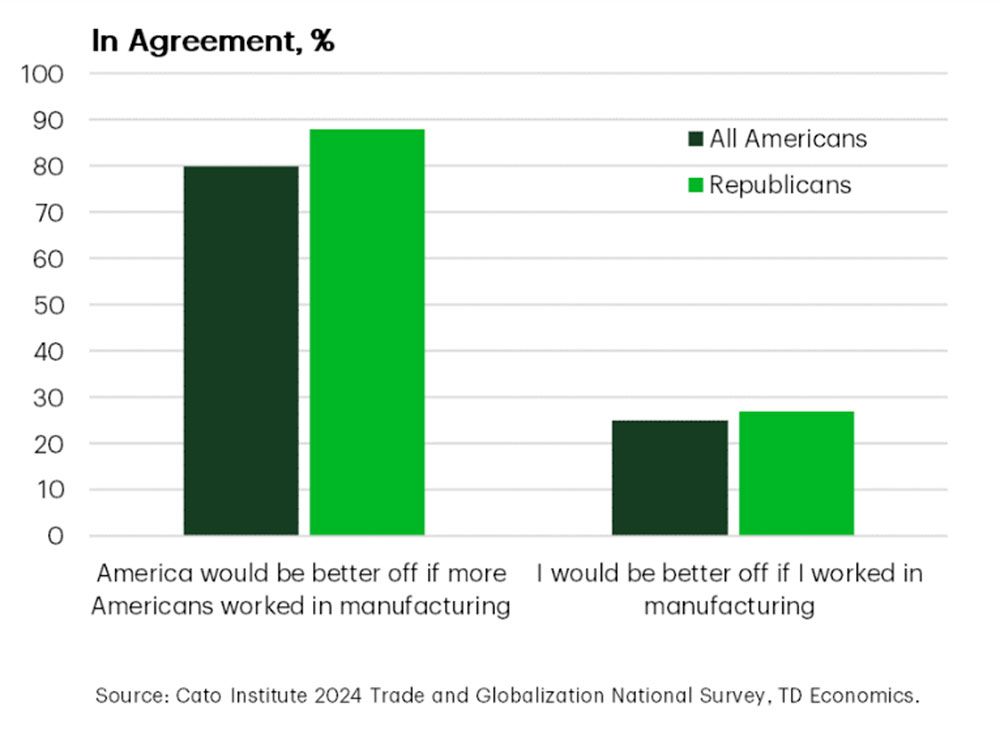

Maybe manufacturing isn’t the American dream. President Donald Trump has made it clear he wants to bring factory jobs back to the United States, but this

chart from TD Economics

suggests the American people might be a bit more ambivalent.

Most agree that there should be more people working in domestic manufacturing, but far fewer think it should be them.

Trump might have a harder time than he thought convincing Americans that they need to pay higher prices to win back factory jobs.

- Today’s Data: United States durable goods orders, Conference Board consumer confidence, S&P CoreLogic Case-Shiller home price index

- Earnings: Bank of Nova Scotia, Autozone Inc.

- How Trump’s ‘big beautiful bill’ could become a big headache for corporate Canada and investors

- Many investors remain unaware of the scale of the unfolding bond crisis

- What you need to know about Canadian Tire, the retail giant that bought Hudson’s Bay brands

Canadian household wealth surged to a new collective high of $17.49 trillion at the end of 2024, and on average Canadians saw their net worth climb 5.77 per cent to reach $1,026,205, fuelled by strong financial asset gains. The Financial Post’s Serah Louis

breaks down the state of household wealth

in Canada — and looks at the uncertainty that lies ahead.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: Burning your mortgage is going the way of rotary phones and station wagons

2025-05-27 11:59:05