A new worry has taken centre stage in global markets this week, upstaging even

Donald Trump’s tariff war

— American debt.

The turnaround started last Friday when Moody’s downgraded the United States’ credit rating, throwing its ballooning deficit into the spotlight. Wrangling over Trump’s “big beautiful” tax bill has just ramped up anxiety.

The concern is that the bill would add trillions of dollars to the deficit just as investors are cooling on U.S. assets. According to the Congressional Budget Office, the bill would add almost $4 trillion to a national debt already approaching $37 trillion. The bill was passed today after an all-night session by the House and now goes on to the Senate.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, says the U.S. has been able to keep borrowing at this scale at a fairly low cost because investors crave U.S. debt.

Treasuries are liquid

, perceived as low risk and feature in every balanced portfolio, including those of central banks.

“What’s changing is that investors are beginning to question whether this ever-growing U.S. debt load is truly viable — and perhaps more importantly, whether it’s as low risk as we pretend it to be,” she said in a morning note.

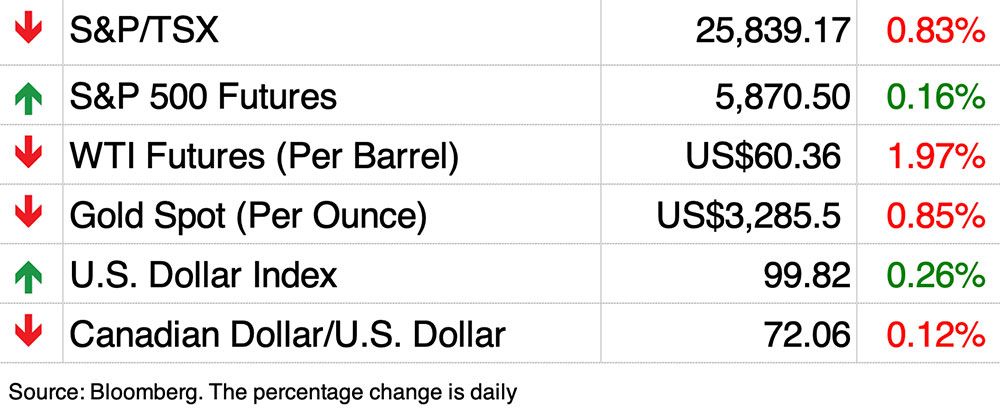

Yesterday investors showed their displeasure by pushing the U.S. Treasury’s 20-year bond yield to 5.1 per cent, just below a two-decade high. The selloff continued across the curve, raising the 10-year to 4.60 per cent and 30-year above 5 per cent.

“This was the market’s way of signalling a lack of confidence in the U.S. government and its policy direction,” said Ozkardeskaya.

The sour sentiment spread to the stock market. The S&P 500 fell 1.6 per cent, the Dow 1.9 per cent, and the Nasdaq 1.4 per cent. Bitcoin, meanwhile, set an all-time high, over US$109,000.

The bottom line, Ozkardeskaya said, is the “U.S. exceptionalism narrative” that has been driving markets is not based on

Apple Inc.

or

Nvidia Corp.

, but on the credibility and strength of the U.S. Treasury market.

“That special status is something investors gave — and something they could take away.”

Could it get worse? Yes, said Ozkardeskaya.

In the 1980s, the 10-year yield topped 15 per cent and the 20-year neared 10 per cent. Ozkardeskaya doesn’t expect a return to those highs, but a spike similar to that seen during the United Kingdom’s mini-budget crisis is possible.

Sign up here to get Posthaste delivered straight to your inbox.

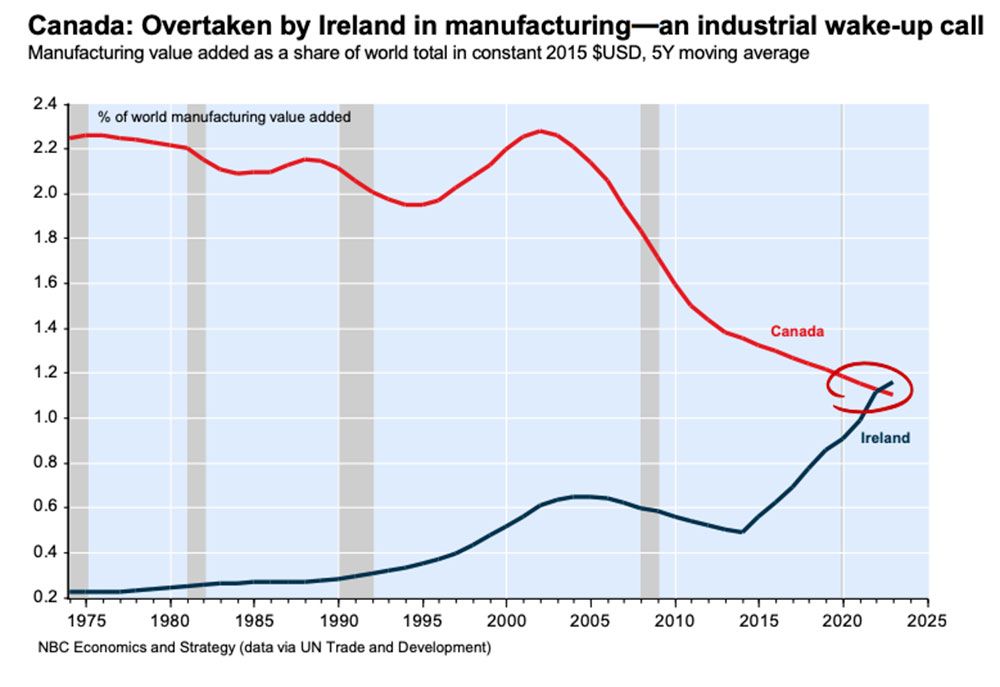

Ireland has just an eighth of Canada’s population, but its factory sector has outgrown ours — and according to the economists at National Bank of Canada, excess regulation is to blame.

Statistics Canada says regulatory requirements for manufacturing have surged 42 per cent since 2005 to total more than 105,000.

“The result has been a profound atrophy of Canada’s manufacturing base — unmatched across the industrialized world,” write Stéfane Marion and Ethan Currie.

- Today’s Data: Canada industrial product and raw materials prices, United States existing home sales

- Earnings: Toronto Dominion Bank, Lightspeed Commerce Inc., Ralph Lauren Corp., Williams-Sonoma Inc.

- Why Canada Post workers are set to strike again and what it means for businesses

- CPP fund not planning to cut U.S. exposure despite ‘wild ride’ in markets, CEO says

- Are the big banks a buy heading into earnings season?

Patricia and Craig both turn 65 in 2026. Until U.S. President Donald Trump’s trade war and all the uncertainty that has caused both in the markets and the economy they had both planned to retire next year. Now they aren’t so sure that’s a realistic goal, especially since they still have a mortgage.

Family Finance looks at the options.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: Trouble is brewing in the world's largest bond market — and that's not good for anyone

2025-05-22 12:15:56