As Canada’s workforce becomes more diverse, it appears the benefits packages offered to employees are not keeping up with the growing needs of workers, particularly among women.

Nearly a quarter of Canadians with chronic physical conditions or developmental disabilities report that their coverage plans are insufficient to meet their needs, while 28 per cent of Canadians with a mental health disability agree,

according to a recent survey from RBC Insurance.

“These findings are a call to action for employers and benefits providers alike, as there’s a real opportunity to close the gap between what employees need and what they receive,” Tony Bruin, head of group benefits at RBC Insurance, said in a news release.

“The more an employer tailors and prioritizes more inclusive and relevant benefit solutions, the more they can truly support their employees.”

When it comes to women, 75 per cent of respondents want or need employer benefits specifically tailored toward their health, such as services for fertility and menopause, but are finding work benefit plans fail to provide the proper coverage.

The survey reported that 31 per cent of women found their work coverage to be insufficient, while 25 per cent had a hard time booking an appointment, both of which were at a higher rate than men.

To address the shortcomings in coverage, more Canadians are looking for specialized add-ons to their plans.

A recent report from Perigon Life

found that 62 per cent of employees want their workplace to offer optional add-ons to their plans, with most willing to spend $15 to $50 per month for the added coverage.

The survey reported that younger Canadians are also having a harder time accessing the proper care. RBC reported that 20 per cent of Canadians aged 18-34 are unsure of their employee benefits, more than other age demographics.

“As the workforce becomes more diverse across age, gender and health needs, employers and group benefits providers have an opportunity to reimagine what modern support looks like,” Bruin said.

“When employers focus on investing in more inclusive, tailored benefits, they can boost employee satisfaction while building healthier, more engaged teams.”

As workers look for expanded care, more employers are looking to save.

An April survey from MercerMarsh Benefits polled nearly 350 Canadian companies and found that 88 per cent are looking to keep benefits plans affordable as 82 per cent of companies look to better understand employee needs.

Sign up here to get Posthaste delivered straight to your inbox.

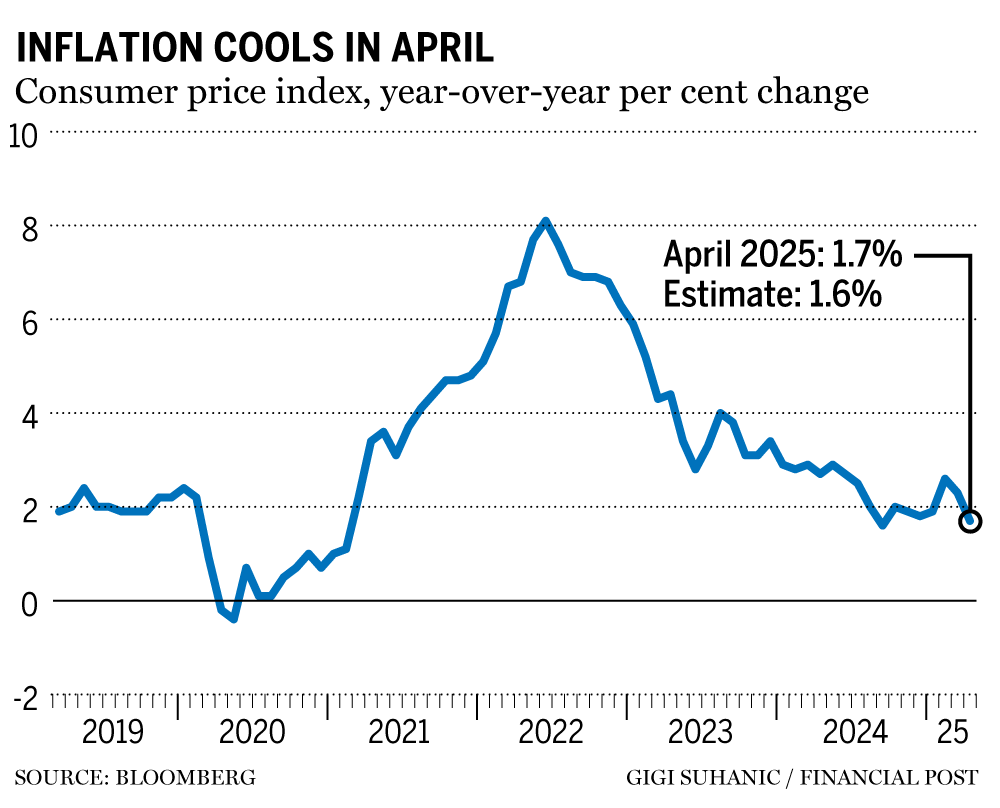

Canada’s inflation rate fell to 1.7 per cent in April, as the removal of the consumer carbon tax and low oil prices helped drive inflation lower for the month.

Excluding energy, Canada’s inflation rate would’ve reached 2.9 per cent, compared to 2.3 per cent in March.

Gas prices led the way in declining consumer prices, falling 18.1 per cent in the month.

The numbers have some economists calling for another interest rate pause in June, though they expect interest rates to fall to 2.25 per cent by the end of the summer.

Read more here.

- G7 Finance Ministers meeting continues

- Premiers from Western Canadian provinces and territories to meet in Yellowknife

- Canadian Club Toronto hosts a panel discussion on ’Outlook on the Canadian Auto Industry: Navigating a New Era of U.S. Tariffs,’ featuring MP Chrystia Freeland

- Today’s Data: New housing price index for April

- Earnings: Lowe’s Companies Inc., Target Corp., Snowflake Inc., Zoom Communications Inc., Canada Goose Holdings Inc.

- Canada’s inflation rate cools to 1.7% as consumer carbon tax ends

- Bank of Canada faces dilemma as core inflation heats up

- Canada Post workers issue strike notice, poised to hit picket lines Friday

- TotalEnergies signs deal to buy LNG from project in Canada

There are several factors to consider when deciding whether to contribute to an RRSP or TFSA account. For someone retiring and depending on their own circumstances, it may be prudent to consider a bigger RRSP contribution and using the tax refund to top-up a TFSA account, writes certified financial planner Allan Norman.

Read here.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Ben Cousins with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: Company benefit plans lag behind the needs of Canadians, survey says

2025-05-21 12:00:59