The Liberal Party of Canada in a stunning turnaround has

won the federal election

and though the final results have yet to come it looks like he will be leading a minority government.

So what does this mean for Canada’s economy?

Even without a majority, Liberal leader

Mark Carney

should be able to implement his fiscal plans with support from the NDP or Bloc Québécois, said Stephen Brown of Capital Economics.

“If anything, the need to grant concessions to those parties means fiscal policy could end up even looser than the Liberals have signalled,” said Brown.

And that could mean a tighter

Bank of Canada.

Follow our live coverage today of the Liberal Party’s win in the federal election featuring market reaction and economic analysis. Find it here

David Rosenberg, of Rosenberg Research & Associates Inc., said the fact that the Liberals will have to team up with a “partner that is even more ambitious on the fiscal front” could be positive for the

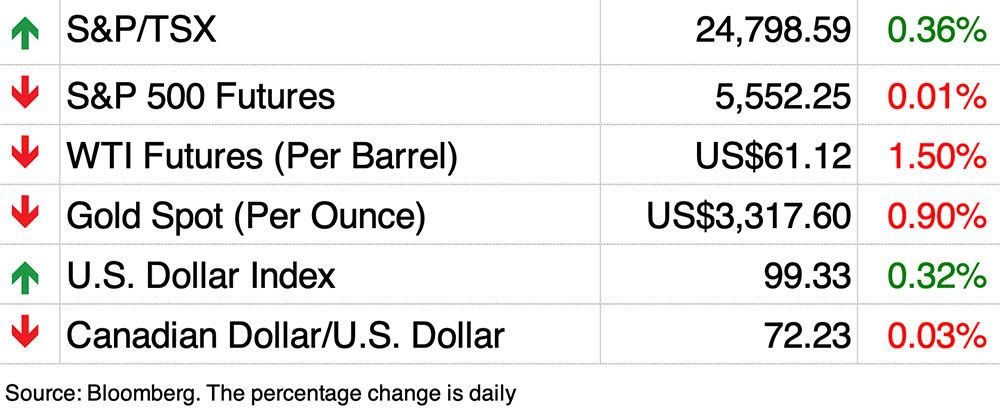

Canadian dollar

because it will mean less pressure on the Bank of Canada to ease monetary policy than if the Conservatives had won.

Capital’s Brown said looser fiscal policy could mean that market expectations of the central bank’s rate settling at 2.25 per cent might be too low.

“That presents a modest risk to our view that the Bank of Canada will cut another three times this year, which would probably prevent the loonie and bond yields from falling by as much as we anticipate,” he wrote.

One thing that looks certain is more red ink.

“Deeper-than-anticipated deficits could be the cost of coalition-building, though the government may wish to hold the line as trailing parties have little interest in heading back to the polls anytime soon,” said Rebekah Young of Scotiabank Economics.

CIBC Capital Markets chief economist Avery Shenfeld said the Liberals may need to put more funds towards other parties’ priorities such as health care for the NDP and support for the metals sector for the Bloc.

Under the Liberals’ plan the deficit is projected to rise to 2 per cent of GDP or about $62 billion, higher than the Parliamentary Budget Officer’s projection of 1.5 per cent of GDP.

Avery said the forecast was reasonable if trade negotiations go well and the economy does not fall into recession this year.

“But there is more downside risk to the economic outlook than upside risk, and the reverse will therefore be true for the budget deficit,” he wrote in a note. “Odds of the deficit topping 2 per cent of GDP are likely more material than an undershoot.”

That would still leave Canadian

federal deficits

at about a third of where the United States is headed, he said.

“The big challenge for Mark Carney will be his need to confront a looming Canadian

recession

,” said Rosenberg.

The economist predicts the downturn will come from three sources: the direct and indirect hits from Donald Trump’s trade war, lingering uncertainty that could freeze business capital spending and hiring and “mounting recessionary pressures in the United States.”

Sign up here to get Posthaste delivered straight to your inbox.

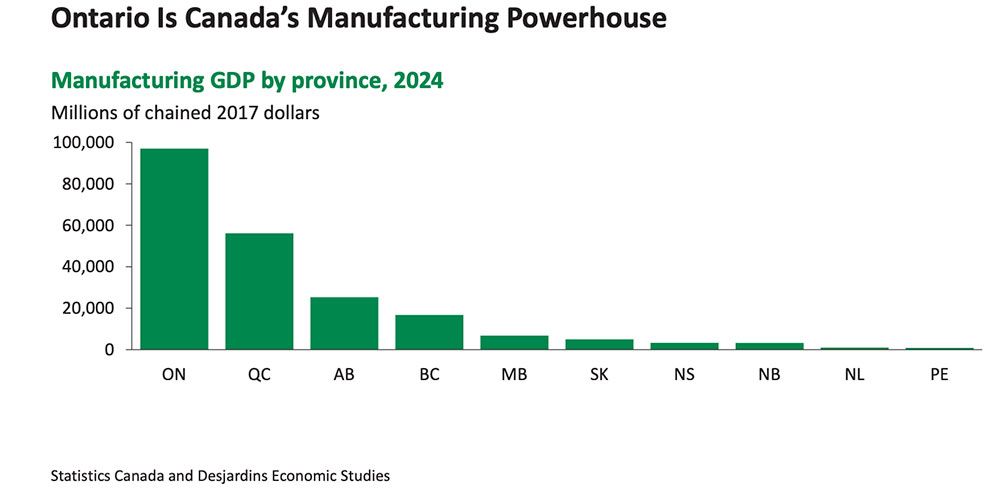

Manufacturing matters to Ontario.

One in 10 jobs in the province are in manufacturing, which is above the national average, and in Windsor, Ont., nearly one in five jobs, said

Desjardins Group

principal economist Florence Jean‑Jacobs.

Though the auto industry is a major employer, food and beverage production is the biggest.

The four key manufacturing sub-sectors — autos, chemical, food and beverages and metals — are fairly evenly split by their contribution to the province’s GDP, she said. Though over the past decade the auto industry’s share has declined from almost 19 per cent to about 16 per cent and the share of chemical and food and beverage manufacturing has increased.

- Today’s Data: United States Conference Board consumer confidence, S&P CoreLogic Case-Shiller Home Price Index

- Earnings: Gildan Activewear Inc., Algoma Steel Group Inc., General Motors Co., Coca-Cola Co., Starbucks Crop., Pfizer Inc., Visa Inc.

- Buy Canadian has to extend to aerospace and defence if Canada is to defend its borders

- Lashing out at staff is bad for business

As the U.S. equity market continues to exhibit tremendous volatility, investor nerves are increasingly frayed. The persistent sell-off and repeated failure of the market to find a solid bottom are raising legitimate concerns about whether further downside risk lies ahead. Investing pro Martin Pelletier says in times like these portfolios built on quality, balance, and adaptability will be best positioned to weather the storm and capitalize on the eventual recovery.

Find out more

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: Bank of Canada might go lighter on rate cuts with Liberals in power

2025-04-29 12:52:05