Whoever wins today’s

federal election

will face the challenge of an economy flatlined by the onslaught of

Donald Trump’s tariffs

and weaker U.S. and global growth, economists predict.

Two days after Canadians vote, gross domestic product data will offer clues on what the next government can expect for the economy — and it’s not likely to be good news.

Royal Bank of Canada economists are forecasting a flat reading for February GDP and the first decline in three months for

GDP per capita.

The early estimate for March could look even softer.

Recent data suggest

Trump’s trade war

may already be impacting the jobs and

housing market

. Canada’s

unemployment rate

climbed to 6.7 per cent in March when the economy unexpectedly lost 33,000 jobs. Home sales are down 12 per cent since January as wary homebuyers bide their time.

Economists are split as to whether

Canada tips into recession

in the months to come, but most expect the economy to show little to no growth in the second half of the year.

After Canada was spared U.S. reciprocal tariffs on April 2, concern has shifted from the impact of higher duties to the damage caused by a decline in the U.S. economy.

“When the neighbour’s house of cards comes crashing down, the dust doesn’t settle at the property line,” said Desjardins Group chief economist Jimmy Jean.

Desjardins expects Canada’s real GDP to contract in the second and third quarters, putting the country in a technical recession.

While fiscal policies should provide a boost, the expected downturn in the United States and lower oil prices, brought on by Trump’s trade war, will offset gains.

Oxford Economics’ forecast is even more dire. They expect a 1.3 per cent peak-to-trough drop in GDP between the second quarter of 2025 and the first quarter of 2026. They now see a deeper recession as U.S. tariffs on other countries weaken Canadian exports, and trade uncertainty “paralyzes private investment.”

Those who think Canada can dodge a recession still see growth slowing to a crawl.

“The second half should see stagnation, but we’re likely to see some fiscal stimulus that might put (Canada) in a situation where we avoid a recession — but there’s nothing set in stone,” said Stefane Marion, National Bank of Canada’s chief economist.

Capital Economics also thinks a recession can be avoided but tariffs on the auto sector and uncertainty about the future of the

Canada-Mexico-United-States Agreement (CUSMA)

will slow GDP growth to an average of 0.7 per cent annualized over the rest of the year and push the unemployment rate towards 7 per cent.

Scotiabank economists, however, think while weak the Canadian economy could end up outperforming the United States. They forecast 1.6 per cent growth for the year.

“While far from strong, this would be significantly stronger than outcomes in the U.S.,” said Scotiabank chief economist Jean-François Perrault.

His reasoning is that Americans face far stiffer tariffs than Canadians, and the U.S. economy is much more sensitive to financial wealth effects than the Canadian economy.

Fiscal support is also more likely in Canada, as shown by campaign promises in the federal election, while Trump has told Americans that short-term pain is needed for long-term gain.

“The starting point for 2025 appears be significantly stronger in Canada than the U.S. at this point, setting the year off on a better path despite the weakness to come,” said Perrault.

The weaker economy should also bring the

Bank of Canada

off the sidelines, economists say. After pausing this month, the central bank is expected to cut at least two more times this year, with some not ruling out a 50 point basis cut in June. The bank’s rate currently stands at 2.75 per cent and terminal rate forecasts range from 2.25 to 1.75 per cent.

Sign up here to get Posthaste delivered straight to your inbox.

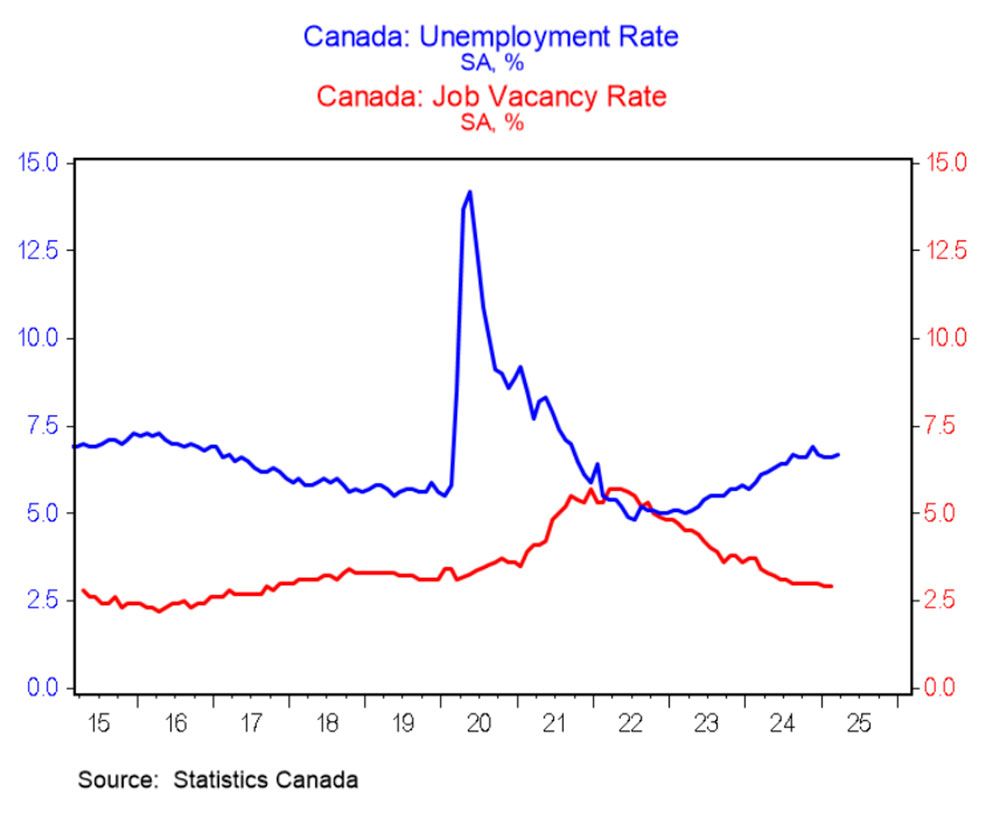

Canada’s

job market

is now weaker than it was before the pandemic as vacancies drop and unemployment rises.

The job vacancy rate slid to 2.9 per cent in February, down from 3.7 per cent a year ago and lower than the 3.2 per cent it averaged in the year before the COVID-19 pandemic, said Douglas Porter, chief economist at BMO Capital Markets.

The unemployment rate, meanwhile, rose to 6.7 per cent this March, up 0.6 percentage points in a year, and about a percentage point higher before the pandemic.

“There are now almost 3 unemployed Canadians for every vacant job,” said Porter. “The trade war could tip the balance even weaker.”

- Canada’s federal election

- First Nation Major Projects Coalition hosts its annual conference in Toronto with speakers including RBC chief executive Dave McKay, BHP CEO Mike Henry and FNMPC chief executive Mark Podlasly.

- Earnings: Domino’s Pizza Inc

- David Rosenberg: Bank of Canada has made a big mistake by being so timid

- What the tech sector wants from the federal election as Canada faces ‘perfect storm’ for foreign takeovers

- More than half of Canadians say housing policies will influence how they will vote

A reader who is pessimistic about the Canadian economy wants to know if U.S. bonds are the best choice to preserve the capital in his nest egg. The investor might want to think twice, says FP Answers, because U.S. bonds are not as safe as they were once thought to be. Risk can be managed but not totally eliminated, so the best strategy is to spread it around by diversifying.

Find out more

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: Canada's federal election winner faces a flatlining economy

2025-04-28 12:01:37