Canada’s

auto industry

was once more in Donald Trump’s sights when the U.S. president suggested Wednesday that he was considering increasing tariffs on the sector.

“I really don’t want cars from Canada,” Trump

said yesterday in the Oval Office

. “So when I put tariffs on Canada, they’re paying 25 per cent, but that could go up in terms of cars. When we put tariffs on, all we’re doing is we’re saying, ‘We don’t want your cars, in all due respect.”

Trump already has a

25 per cent tariff

on autos imported to the United States, but there are exemptions related to the

Canada-U.S.-Mexico Agreement (CUSMA)

. Another tariff on auto parts not compliant with CUSMA could come by May 3.

For the time being, Canada and Mexico still hold some competitive advantage over other countries, said Florence Jean-Jacobs, principal economist for Desjardins Group.

“But with the tariff situation constantly in flux and the stated objective of the U.S. administration to reshore auto manufacturing, Canada’s auto sector is still in a vulnerable position,”

she said in a report yesterday.

The integrated supply chain between the two countries has been decades in the making, and it would take a “substantial investment” to replace it.

“Still, for manufacturers with factories producing similar goods on both U.S. and Canadian soil, we may see a greater increase in investment in U.S. plants, to the detriment of Canadian facilities,” said Jean-Jacobs.

In Ontario, Canada’s manufacturing heartland, the auto industry and primary metal manufacturing stand out as most at risk in a trade war, she said.

Two thirds of auto revenues come from exports to the United States, making it the most exposed of the province’s industries. It is also capital intensive and regionally concentrated, making it harder to adjust quickly to shocks.

“Job and productive capacity losses could become lasting if tariffs persist over an extended period,” she said — and that would pose a risk to the province’s economy.

About 4.5 per cent of jobs in Ontario are in industries vulnerable to the trade war, with the auto industry representing 65,000 of them.

Ford Motor Co.

,

General Motors Co.

, Stellantis NV, Honda Motor Co. and Toyota Motor Co. all make cars in Ontario and there has already been disruption.

GM’s CAMI Assembly plant in Ingersoll, Ont. has

announced it will shut the plant

next month and reopen in October at half capacity because of decreased market demand. Up to 500 workers will lose their jobs

After tariffs were first announced,

Stellantis, which makes Chrysler and Dodge vehicles

, shut its Windsor plant for two weeks.

“The current trade environment will inevitably cause some difficult reshuffling of factors of production in Ontario’s economy in 2025 and 2026, and job losses appear unavoidable,” said Jean-Jacobs.

“We expect the auto sector to struggle most given its integrated value chains with the U.S. and high dependence on this export market.”

If the tariffs remain in place for the rest of the year and CUSMA compliance does not improve, Ontario’s

unemployment rate

could near 9 per cent by the end of year, she said.

Sign up here to get Posthaste delivered straight to your inbox.

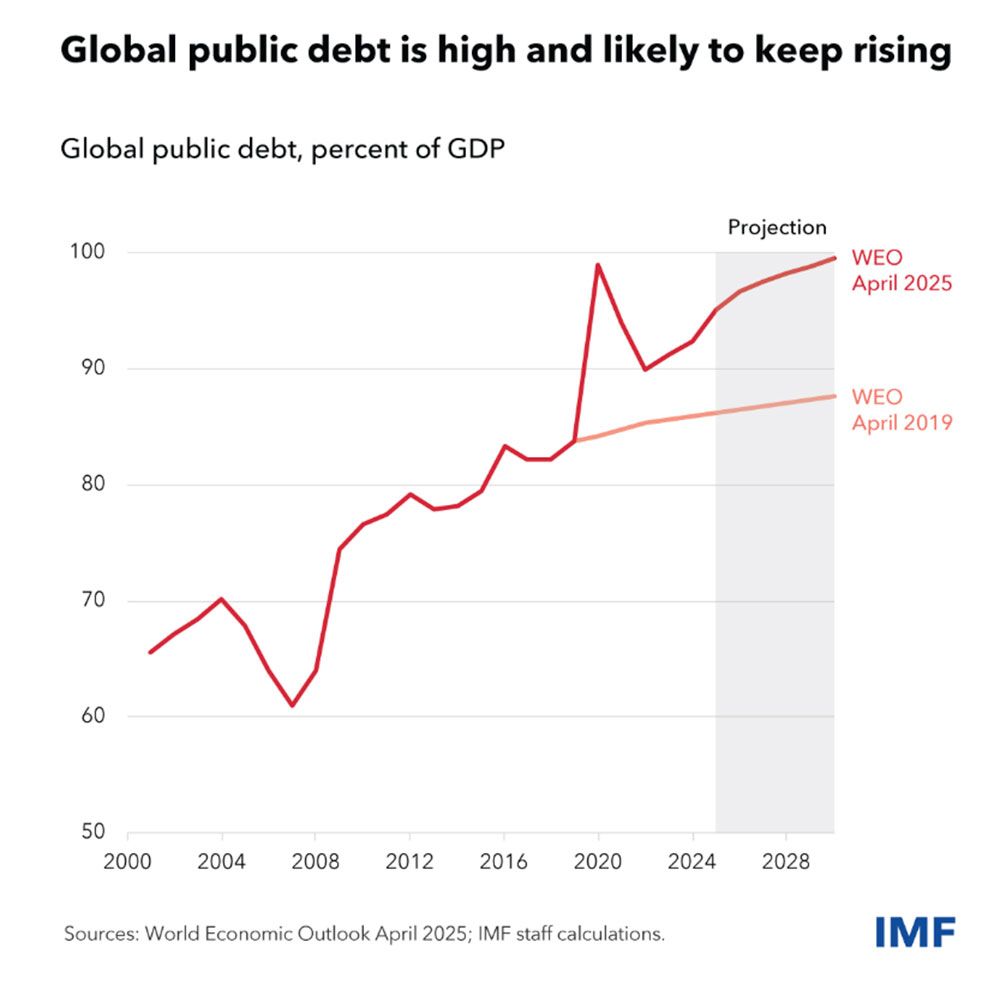

As trade tensions grip the world, the

International Monetary Fund

has a warning for countries — watch your debt.

The

IMF expects public debt

to jump 2.8 percentage points this year as tariffs lower growth and increase inflation. As its chart shows, that would put global public debt on track to reach nearly 100 per cent of GDP by the end of the decade, surpassing the pandemic peak.

In the worst case scenario, public debt could hit 117 per cent of GDP by 2027, the highest level since the Second World War and 20 percentage points higher than previous projections.

Escalating geopolitical uncertainty could heighten debt risks by pushing up spending on defence and public aid programs, said the Washington-based global lender. Tighter and more volatile financial conditions in the United States could increase financing costs in other countries.

“In an uncertain and rapidly changing world, countries will need to first and foremost put their own fiscal house in order,” said the IMF.

- Today’s Data: United States durable goods orders, existing home sales

- Earnings: Teck Resources Ltd., Agnico Eagle Mines Ltd., Alphabet Inc., PepsiCo Inc., Procter & Gamble Co., Southwest Airlines Co., Nasdaq Inc., Hasbro Inc., Intel Corp., Celestica Inc.

- Jamie Golombek answers questions about the federal election and your taxes

- The Canadian dollar is diving against other major currencies despite gaining against the greenback

- Election promises add up to deficits — and that’s without calculating an economic slowdown

Questions about your taxes and the federal election? Take a look at our Q&A with tax expert Jamie Golombek to get answers on how the election could affect your personal finances.

Find out more

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

YouTube channel

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

posthaste@postmedia.com

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Posthaste: Job losses 'unavoidable' in Canada's auto sector as Donald Trump doubles down on tariff threat

2025-04-24 12:13:27